When you’re working as a freelancer or entrepreneur, it can be difficult to keep your finances in order. A business checking account will help you stay organized and make managing your money easier.

If you’re looking for a new business checking account, there are several banks that offer accounts designed specifically for freelancers and entrepreneurs. Some of the banks below even offer bonus incentives or discounts that’ll make your freelancing life a lot easier.

In a hurry? Our pick is NorthOne as the best bank for freelancers in 2022.

Best Business Bank Accounts for Freelancers and Self-Employed Workers

Self-employment refers to a wide range of occupations, from running your own retail store to freelancing as a side hustle.

It’s critical to keep your business income separate from your personal checking account by using a business checking account, regardless of where you fall on the spectrum.

This will simplify your bookkeeping and enable you to calculate self-employment taxes more easily come year-end.

Depending on your specific requirements, one business account may be better suited for you over another. However, most small business checking accounts should be simple to set up, get access to, and charge low fees.

Here are some of the best business checking accounts for freelancers and the self-employed.

1. NorthOne Business Banking

| Monthly fee: | $10 |

| Minimum opening deposit requirement: | $50 |

| APY: | None |

| Transactions: | Unlimited fee-free transactions |

| Bonus: | Get a $20 bonus when you open and fund a new NorthOne Account |

NorthOne is a great place for freelancers to start their business banking. It’s a standout bank that takes just $50 to open an account. The bank has a low monthly maintenance fee of only $10 but doesn’t have any monthly balance requirements or minimum deposits.

NorthOne has some of the best integration and features:

- Works with billing systems like Stripe, Quickbooks, Shopify, and Square

- Supports all modern payments types

- Pay invoices

- Simple and powerful insights into your cashflow

Interest-bearing accounts are not available, but you enjoy unlimited fee-free transactions and a ton of online tools to help you manage your business banking. You also don’t need a branch to operate your account with NorthOne banks because mobile banking and mobile check deposit are available.

Get $20 welcome bonus

NorthOne Business Banking

5.0

NorthOne offers a variety of online and digital tools to manage your business banking. Open an account in as little as 3 minutes. Join now with no commitments, no minimum balance, and cancel anytime.

2. Lili Bank Acccount

| Monthly fee: | $0 |

| Minimum opening deposit requirement: | $0 |

| APY: | None |

| Transactions: | Unlimited fee-free transactions |

| Bonus: | None |

Lili is a bank for freelancers that opens its business checking services to anyone who wants to join. Lili offers banking, expense management and other tax-saving tools designed to save you time and money.

There are no monthly fees with a Lili account, minimum balance requirements, or a minimum opening deposit. You can withdraw your money for free with ATM access through the MoneyPass network.

When you’re paid via direct deposit, your money is available in your Lili account up to 2 days earlier than if you were banking with a traditional bank. And they have an app that makes it easy for you to check your balance and transfer funds from anywhere you are.

Lili Bank Account

4.4

Stay in control. Save on taxes. No account fees and no minimum balance. By combining banking with accounting software and technology to optimize tax liability, Lili is designed to save time, money and energy for anyone who runs a business on their own.

3. Found Business Checking

| Monthly fee: | $0 |

| Minimum opening deposit requirement: | $0 |

| APY: | None |

| Transactions: | Unlimited |

| Bonus: | None |

Found’s free business banking is built for the self-employed. It stands out from the crowd thanks to smart tax and bookkeeping features. The Found business debit Mastercard automatically tracks and categorizes your expenses, helping you save on taxes. Found estimates your tax bill in real time—then sets aside the right amount so you’ll have enough saved for taxes.

Send custom invoices, save receipts, run reports, even pay your taxes right in the app—all for free. Link Found to your payment apps or other bank accounts for seamless money movement. Found’s features eliminate the need to toggle between platforms or pay for clunky financial tools. In all, Found offers reliable business banking and robust features, with no fees or minimums—saving you time and money.

Found Business Checking

4.5

Found Business Checking offers a fully digital business checking account with no monthly fees, no credit checks, a free debit card, and built-in bookkeeping, invoicing, and tax tools.

4. Axos Basic Business Banking

| Monthly fee: | $0 |

| Minimum opening deposit requirement: | $1,000 |

| APY: | None |

| Transactions: | – Up to 200 fee-free items per month, 30 cents per item after – Up to 60 fee-free remote deposits per month, 30 cents per deposit after |

| Bonus: | $200 welcome bonus for eligible freelancers |

Axos Bank has a Basic Business Checking account designed for small businesses and freelancers with moderate account activity. The Axos Basic Business Banking account has no monthly maintenance fees and a low minimum deposit requirement of $1,000 to open an account.

If you want to have interest checking you can upgrade to Business Interest Checking (0.81%). Small business owners can also benefit from small business savings accounts with APY’s starting at 0.20%. Axos has one of the best business bank accounts overall. For a limited time, get a $100 bonus with promo code EARN100 through this link.

$200 bonus

Axos Basic Business Checking

4.0

AXOS is an online bank that focuses on simple business banking online. It’s free, and you get no monthly maintenance fees, a low minimum deposit requirement, and unlimited domestic ATM fee reimbursements.

Related: Axos Bank Promotions

5. Novo

| Monthly fee: | $0 |

| Minimum opening deposit requirement: | $50 |

| APY: | None |

| Transactions: | Unlimited |

| Bonus: | None |

If you’re looking for a business checking account that has low fees, Novo could be the right place for you. Unlike some major banks, Novo doesn’t charge a monthly service fee and is fee-free. Business accounts at Novo banks are free to open with no monthly minimum balance requirement.

Manage your business finances on the go. Connect Novo to your tools, send invoices, pay, get paid, and much more. Link your other bank accounts to Novo for seamless transfers. A neat feature is Novo Reserves, which allow you to set aside funds for taxes, profit, payroll, and other large business expenses.

And, if you want to withdraw your money for free, there’s also an option that lets you do just that. Small businesses and self-employed freelancers alike would benefit from a free business checking account from Novo.

Novo

4.4

Get a business edge with an award-winning, free business checking account from Novo. With no monthly fees, unlimited refunds for ATM charges and a focus on digital banking, Novo business checking is a great option for small-business owners on the go.

6. Chase Business Complete Checking℠

| Monthly fee: | $15 (multiple ways to waive including maintaining a minimum daily balance of $2,000). |

| Minimum opening deposit requirement: | $0 |

| APY: | None |

| Transactions: | – Unlimited electronic deposits – 20 free teller and paper transactions per month |

| Bonus: | $300 sign-up bonus |

The Chase Business Complete Checking account is another good solution for freelancers with larger businesses that need more advanced banking services.

This account offers unlimited transactions and a free business debit card, online bill pay, and a mobile app to keep up with your expenses.

You’ll also get a dedicated banker to help you manage your money so filing taxes is less of a hassle.

Opportunity to earn $300 sign-up bonus

Chase Business Complete Banking℠

4.9

Chase Business Complete Banking℠ takes care of the basics, so you can focus on growing your business. This digital-friendly Chase business checking account is ideal for small-business owners who want branch access.

7. Live Oak Small Business Checking

Live Oak’s small business checking account has the key components of a business checking account without the unnecessary features and fees found at a typical bank. Designed with simplicity for newly-formed businesses, solopreneurs, gig-workers, freelancers, and side-hustlers.

This account is a good fit for businesses that:

- Take payment via Venmo, Square, PayPal or Stripe

- Make smaller or limited monthly transactions

- The business owner manages the finances

- Do not need to make cash deposits

Live Oak also provides one-on-one onboarding guidance to customers to help them transition their business to Live Oak.

In addition to being the nation’s top SBA lender, Live Oak offers high-yield business savings accounts and small business checking accounts built for the self-employed. The small business checking account can be opened and managed online for free and provides human-powered customer support. Overall, it’s one of the best free business checking accounts available.

Live Oak Small Business Checking

4.2

Live Oak offers easy-access checking with no account opening or monthly fees. Small-business owners looking for financing or consumers looking for high-yield deposit products may want to consider opening an account at Live Oak Bank. Sign-up online in minutes.

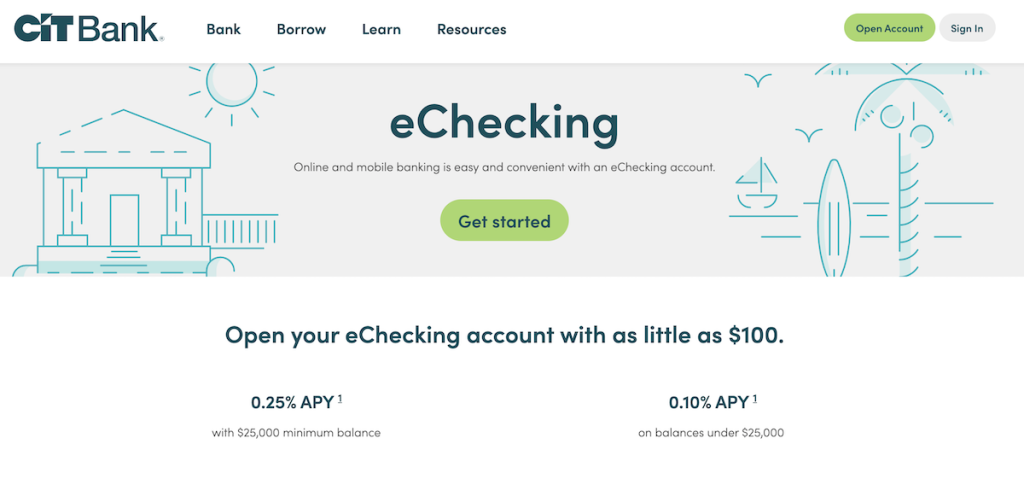

8. CIT eChecking

| Monthly fee: | $0 |

| Minimum opening deposit requirement: | $100 |

| APY: | 0.25% |

| Transactions: | Unlimited |

| Bonus: | None |

CIT’s eChecking account that is one of the best banks for freelancers because they let you open a business checking account with just $100 to get started.

If you don’t have your business license yet but don’t want to comingle your personal and freelancing finances — CIT eChecking is a great place to start.

Forget about monthly fees or minimum balance requirements when using this bank because there are none – ever! CIT Bank does not charge ATM fees. Get up to $30 in other bank’s ATM fees reimbursed per month.

Plus you can deposit checks and make unlimited withdrawal and disbursements with the CIT Bank mobile app. You can also easily set travel alerts or stop/restrict use on your debit card.

CIT eChecking

3.9

Online and mobile banking is easy and convenient with an eChecking account. CIT customers can access checking accounts 24 hours a day online or through the mobile app. Checking accounts can be opened with a $100 minimum opening deposit.

9. Current

| Monthly fee: | – $0 for basic account – $4.99/month for premium account – $36/year for a teen account |

| Minimum opening deposit requirement: | $0 |

| APY: | None |

| Transactions: | Unlimited |

| Bonus: | $50 bonus eligible for new Premium members + an eligible direct deposit of $200 or more |

Current offers banking features and is free to open with no monthly fees but it is not specifically a business checking account. It’s a good option for those who want the luxuries of a digital-only app in order to separate business and personal spending.

It’s worthwhile to consider, as you’ll also get access to Overdrive™ which gives qualified premium members up to $200 in fee-free overdrafts with no fees. And you can get paychecks up to two days faster than traditional banks when you sign up for direct deposit with your Current Premium Account.

Current also has mobile banking and online check deposit services so managing your finances is easier than ever before. Get 15x points when you swipe your card at participating merchants, which can be redeemed for cash in your Current Premium account.

There isn’t any minimum amount of money required to open or maintain an account and Current does not charge any hidden fees.

Current

4.5

Current is a mobile banking app with a Visa debit card that gets you paid up to two days faster with direct deposit and gives you free overdraft up to $200 with no hidden fees. Earn up to 15x points on purchases that are redeemable for cash back, 55,000 fee-free in-network ATMs, and instant gas hold refunds.

10. Chime

| Monthly fee: | $0 |

| Minimum opening deposit requirement: | $0 |

| APY: | 1.50%* |

| Transactions: | Unlimited |

| Bonus: | None |

Chime doesn’t offer a business banking account but it does offer a free personal checking account. This account is designed specifically for freelancers and entrepreneurs because it comes with no monthly fees or minimum balance limits.

Chime also has an app that lets you manage your money from anywhere you are while earning 1.50% APY* on your deposits, through Chime High Yield Savings, or giving you quick access to cash without any withdrawal limits. And it has no-fee ATM access at more than 60,000 ATMs in all of the US1.

Chime

4.5

Chime is an award-winning mobile banking app with no monthly fees that can get you paid up to 2 days early with direct deposit. With over 135,000+ five-star reviews, Chime makes mobile banking easy with a modern and intuitive banking app that handles everything from tracking your spending and savings to paying friends.

1 Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM.

*The Annual Percentage Yield (“APY”) for the Chime Savings Account is variable and may change at any time. The disclosed APY is effective as of August 25th, 2022. No minimum balance required. Must have $0.01 in savings to earn interest.

11. Oxygen

| Monthly fee: | $0 |

| Minimum opening deposit requirement: | $0 |

| APY: | None |

| Transactions: | Unlimited fee-free transactions |

| Bonus: | None |

Oxygen is a modern digital banking platform for the 21st-century economy – the free thinkers, rebels, and entrepreneurs.

You can earn 5% cashback on everyday business purchases at approved merchants on things like gas, rideshare, shipping and more. No points and gimmicks. Just real money. With no monthly, minimum balance or ACH fees to hold you back, you can make your business boom.

Oxygen is a great bank for freelancers just starting out, with no minimum opening deposit required to open and no monthly fees. The Oxygen banks app makes it easy to deposit checks and manage your money on the go. If you’re looking for a full-service option with checking accounts, savings accounts and educational resources, this might be the right choice for you.

12. Nearside

Get the Nearside Business Checking account designed for small businesses with no NSF fees, up to 2.2% cashback rewards, perks, and discounts. Get all this and more with no minimum deposit or monthly fee.

This card has perks like automatic rewards on all of your purchases. Get unlimited 2.2% cashback in 2022 on every purchase for your business with the Nearside debit card. Your cashback rewards will automatically be applied to your statement after making eligible debit card purchases.

No more worrying about monthly fees, NSF fees, monthly minimums, card replacement fees, or other fees you’d expect from a traditional bank. Also, your money is FDIC insured through LendingClub Bank, Member FDIC.

The application process is quick and easy. Applying only takes a few minutes!

Nearside

4.1

Get the business checking account designed for small businesses with no NSF fees, up to 5% cashback rewards, perks, and discounts. Get all this and more with no minimum deposit or monthly fee.

13. LendingClub Business Checking

| Monthly fee: | $10 (waived with average monthly balance of $5,000+) |

| Minimum opening deposit requirement: | $100 |

| APY: | 0.10% on balances of $5,000+ |

| Transactions: | Unlimited |

| Bonus: | None |

As a business owner, you may have used LendingClub banks as a way to get a startup business loan. In fact, LendingClub has acquired Radius Bank and now has business checking accounts designed specifically for entrepreneurs and freelancers so they can manage their money more effectively.

LendingClub offers you 0.10% APY on balances of $5,000+ on your money and gives you access to your cash without monthly withdrawal limits. And it also has mobile banking and online check deposit services that make it easy for you to manage your money from anywhere.

Other Traditional Banks to Consider

The business checking accounts below are from top national banks and come with hefty fees and minimum requirements. So they aren’t best suited for freelancers, but you can take a look and see if they are for you.

14. NFCU Business Checking

| Monthly fee: | $0 |

| Minimum opening deposit requirement: | $100 for sole proprietorships, $105 for all other entity types |

| APY: | 0.01% |

| Transactions: | – Unlimited fee-free electronic transactions – Up to 30 fee-free non-electronic transactions per month, then 25 cents per item |

| Bonus: | None |

Navy Federal Credit Union is a great credit union for small business owners who want to make their money grow. It has no monthly fees, low minimum balances, and you can make cash deposits or withdraw your money for free from any NFCU locations or Allpoint ATMs. If you use any other ATM, you’ll face ATM fees. You also get personalized service from the credit union’s knowledgeable staff when you open an account. If you’re currently a Navy Federal Credit Union member, it’s easy to sign up for a free business checking account, and quite convenient.

Related: Credit Unions vs Banks: Which is Best for You?

15. Capital One Spark Business Basic Checking

| Monthly fee: | $15, waived with a minimum balance of $2,000+ over 30- or 90- day average, whichever is greater. |

| Minimum opening deposit requirement: | $250 |

| APY: | None |

| Transactions: | Unlimited |

| Cash deposits: | Up to $5,000 per month with no fee, after that $1 fee per $1,000 deposited. |

| Domestic wire transfers: | $15 for incoming domestic wires, $25 for outgoing domestic wires. |

| Bonus: | None |

If you’re a freelancer who banks online, check out Capital One’s Spark Business Basic Checking. Each month you’ll get unlimited transactions included, along with free Overdraft Protection with a linked Capital One small business deposit account. Also, you’ll get a business debit card, online bill pay and online and mobile checking at no additional cost. It’s the checking account your business can count on for its cash flow management needs.

16. Wells Fargo’s Initiate Business Checking

| Monthly fee: | $10, waived with a minimum daily balance of $500 or $1,000 average ledger balance. |

| Minimum opening deposit requirement: | $25 |

| APY: | None |

| Transactions: | Up to 100 fee-free transactions per month, then 50 cents per transaction after that. |

| Cash deposits: | Up to $5,000 per month with no fee, after that 30 cents per $100 deposited. |

| Waived incidental fees: | None |

| Bonus: | None |

For freelancers with larger businesses that require more than just an average business checking account, consider applying for Wells Fargo’s Initiate Business Checking account. This is designed specifically for ambitious business owners building a foundation. Here you can reinforce your brand by adding your logo to checks and your business debit card. Plus you can convenience of paying vendors, employees, and bills using the full range of payment services. All include enhanced safety and security. The monthly service fee is $10 but is waived with a minimum daily balance of $500 or $1,000 average ledger balance.

17. Bank of America Business Advantage Checking Account

| Monthly fee: | $16 (waived with a $5,000 combined average monthly balance or by spending $250 in net new qualifying purchases on a business debit card) |

| Minimum opening deposit requirement: | $100 |

| APY: | None |

| Transactions: | Unlimited fee-free electronic transactions (ACH, debit card transactions, electronic debits, deposits made with mobile check deposit, remote deposit online or at a Bank of America ATM). Up to 200 fee-free non-electronic transactions (checks paid, other debits, deposited items), then 45 cents per item. |

| Cash deposits: | Up to $7,500 free, then 30 cents per $100 deposited. |

| Waived additional fees: | None |

| Bonus: | There are a few Bank of America new account bonuses available. |

Bank of America offers another reliable business checking account traditional features you’ll get from most national banks that offer checking accounts. You’ll get unlimited check writing and a free Visa debit card to make managing your money easier, in addition to access to 17,000 Bank of America ATMs and 4,300 branch locations across the U.S.

Best Bank Accounts for Entrepreneurs FAQs

Should I have a separate bank account for freelance?

Yes. Even if you only freelance part-time, it’s important to keep your businesses separate. This makes it much easier to manage your money and make tax preparations at the end of the year too.

How do banks for freelancers make their money?

Many banks make most of their money by charging customers high transaction fees or monthly minimum balances that prevent a lot of people from using their accounts. Some banks also use overdraft fees and other bank fees to generate extra revenue as well. You can avoid bank fees by using no-fee banks like Lili.

How long does it take to set up a business checking account?

On average, setting up a business checking account takes about 10 minutes for online banks and longer for brick-and-mortar locations. You’ll need an employer identification number (EIN) and a list of banks where you currently do business.

What banks for freelancers offer free transactions?

Many banks and credit unions offer free standard transactions, but there are some banks that will charge customers extra fees based on the amount they’re using their accounts for. These include overdraft and service fees in the hundreds of dollars every month. In order to keep these types of charges from building up, it’s best to find a bank designed specifically for entrepreneurs who need lower rates when making larger transactions.

How does interest work with banks for freelancers?

In general, banks have higher interest rates when you deposit more money in your regular checking account or in a savings account. Some banks also have different tiers which give you access to even higher interests rates on a monthly or daily basis.

How can banks for freelancers help my business?

Banks specifically designed to manage your money have better tools and features that can keep track of your transactions, warn you of overdrafts, and allow you access to funds faster. In addition, some banks offer business banking products such as credit cards tailored specifically for entrepreneurs who make up their own company name instead of using the traditional “incorporated” label.

What banks for freelancers should I avoid?

Some banks are designed with very little customer service or support which will make it difficult to contact them in an emergency situation. It’s also best to avoid banks that charge too many transaction fees if you’re making multiple purchases.

Best Banks for Freelancers Summary

If you’ve been struggling with keeping up with all of your expenses while freelancing, these banks offer some great options for managing your money better and streamlining your tax season. Even if you’re just starting out, a good business checking account can save you time and headaches in the future.

Freelancers now have more options than ever when it comes to banks where they can manage their money and grow their businesses. And if you’re unsure about how much your current bank is charging you for checking accounts, fees or minimum balance requirements it might be time to check out what these banks have to offer instead.