Debt is a slippery slope. It sucks.

After all, no one wants to be in debt if they can help it, but for many, it can be difficult to find ways to pay off debt fast.

According to a 2020 Experian study, the average American carries $92,727 in consumer debt.

Whether your debt is a result of bad luck or bad spending habits, it’s important that you’re aware the game’s not over just yet.

There’s a way out, and it’ll take a great deal of determination and hard work to get you back on track with your finances. But paying off debt should be your number one goal.

Whether you want to pay off 10k in debt, pay off 15k in debt, pay off 20k in debt, or pay off 25k in debt — it’s possible.

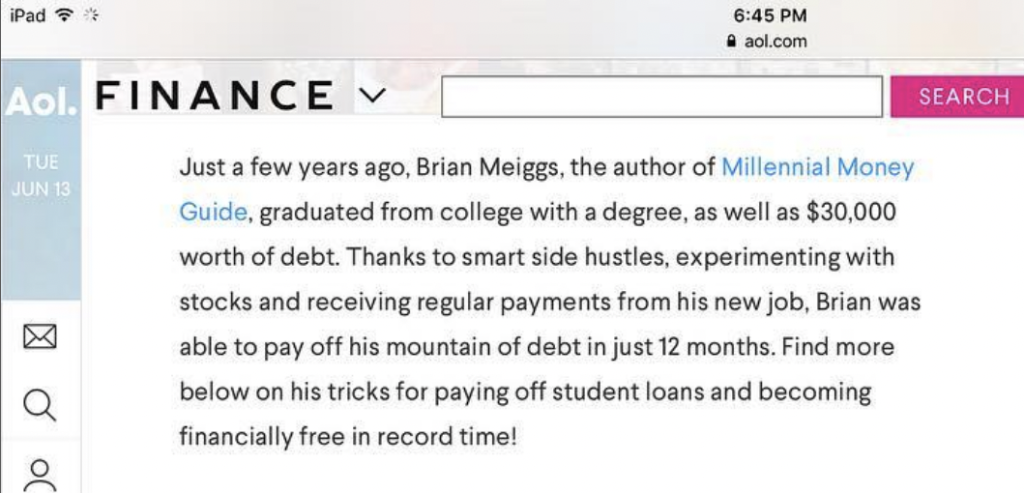

I was featured on AOL after paying off $30k of student loan debt within 12 months after graduating college — I know a thing or two about hacks to get rid of debt. Proof below:

But this will apply to all types of debt. No matter the level of turmoil you’re experiencing, remember that you can use these brilliant strategies to pay off debts faster.

I created this free guide so you can follow the path I created so you can finally become debt free

How to Pay Off Debt Fast

In the United States and abroad, there are millions of people who have gotten themselves into big debt. The unfortunate truth is that many people take their money for granted until it is too late.

If you do this, there is a good chance that you’re going to get yourself into trouble as well. Just remember that there are plenty of things you can do to dig yourself out of that rut.

Below, you’re going to learn about some of the best ways to pay off debt. Here are the most effective ways to deal with your debt starting today.

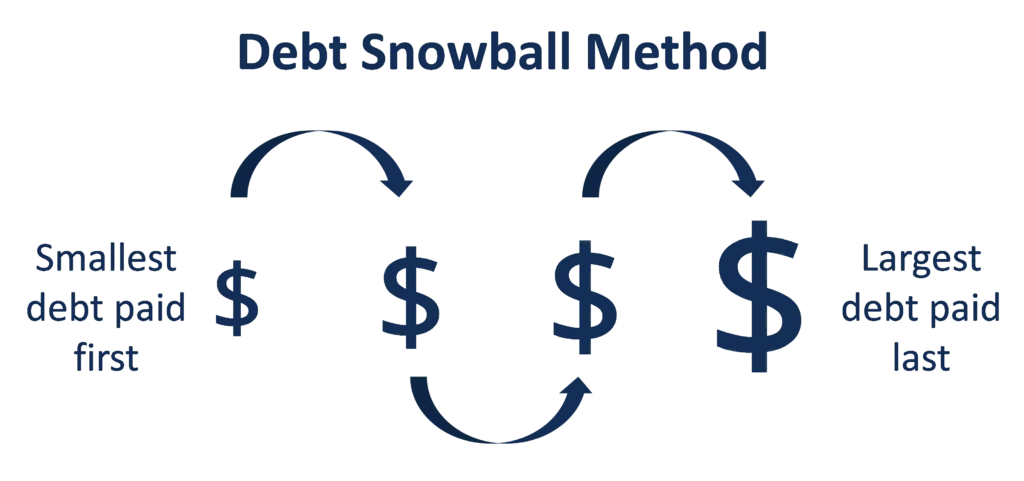

1. Debt-Snowball Method

The debt snowball method is what I used in the past to pay down my debt. I also like the fact that it builds momentum as you see your debts get paid off one by one.

To use the debt snowball method, you list your debts from smallest to largest, making sure to include interest rates. You then focus on paying off the smallest debt first, while making minimum payments on your other debts. Once the smallest debt is paid off, you move on to the next smallest debt, and so on.

The snowball method can be an effective way to pay down debt because it gives you a sense of progress as you see your debts getting smaller and smaller. Additionally, the momentum from paying off one debt can help motivate you to keep going and pay off your other debts.

If you’re struggling with debt, the debt snowball method may be a good option for you. Give it a try and see how it works for you. You may be surprised at how quickly you can pay off your debts using this method.

It’s a great method to pay off debt if you have multiple debt accounts such as:

Basically, anything owed to someone is considered debt. To begin paying off debt the smart way, you would pay off the debt accounts starting with the smallest balances first, while paying the minimum payment on larger debts.

After you pay off the smallest balance, take the money you were using on that balance and roll it over to the next debt balance. Repeat this method until you have paid off all of your debt accounts.

The debt-snowball method is one of the best things you can do in order to pay off your debt fast. You can also use a debt payoff planner or debt payoff calculator to help you prioritize your debt effectively using the debt snowball method.

2. Don’t Settle for Being in Debt

This may be tough to hear but your life is determined by the things you do on a daily basis. Today, after reading all of these steps below how many actions will you really take to get out of debt?

Most successful people in life aren’t lazy because they work hard for what they have and you need to as well. Never settle.

Continue to live below your means and learn how to grow and better your situation for yourself and your family. You don’t need to close your credit accounts, but cutting or hiding your card will help you avoid the temptation of overspending.

Debt can be a real burden, both financially and emotionally. It can seem like there’s no way out, but there is. You don’t have to settle for being in debt. There are things you can do to get out of debt and start fresh.

3. Figure Out How Much Debt You’re In

To better get rid of your debt it’s important to get an overall picture of your financial health.

This really means figuring out how much debt you have from all your different debt accounts. Think about it, if you do not have a starting point, how can you get out of debt in the long term?

Most people use free money management and budgeting tools like Empower.

Empower

5.0

Take control of your finances with Empower’s free personal finance tools. Get access to wealth management services and free financial management tools.

If this is something you are not already utilizing that should be your next step.

Empower is a free online money management and budgeting tool that tracks all of your bank and credit card accounts so you know exactly where you stand.

When using budgeting tools like this, you can add a monthly budget to cover your interest payments so you know how much money is really going towards paying down your debt.

To pay off all of your debts as rapidly as feasible, keep track of what you owe and obtain a free credit report card.

By checking your credit score and working to fix any discrepancies or building it higher you can pay less in interest, which will help you pay off debt faster.

If you don’t know your credit score, you can use free services like Credit Insights by SoFi which gives you your score for free. You can find out your score in under a minute!

4. Steady Thoughts Win the Race for Paying Off Debt Fast

While debt can be a result of circumstances beyond your control, it’s important that you use this time to reflect on your own habits and behaviors.

If you’re responsible for the mess you are in, a bit of introspection will work wonders for your future finances.

Where did you go wrong? How can you do better next time?

Audit yourself and own up to your problems, as responsibility can mean that half of the battle is won already.

Don’t waste time pointing fingers and get to work. After all, any kind of debt can cause psychological issues just as much as financial ones, and you’re only going to make things worse if you’re not thinking about the right things.

Remove all thoughts of blame, self-doubt and even guilt from your mind, and use hope and determination as your fuels to get you through. Your thoughts and feelings count for a lot in a situation like this!

5. Look at Your Monthly Payments for Adjustments

Just because a cable company or cell phone provider quotes you a price doesn’t mean it’s the best one they can offer you.

Seriously, I’ve lowered my AT&T bill by doing this.

You can find ways to pay less on your bills by contacting your service providers which you have a regular monthly bill for, for example:

- Phone (Home, Cell Phone)

- Insurance

- Cable

- Internet

- Credit Cards

If you contact them and speak to the retention department, you can explain that you have been offered a better deal elsewhere.

They may be able to negotiate a better price for you, especially if you are a long-term, loyal customer.

If they can’t offer you a better deal, it may be worth switching providers.

For example, a lot of millennials are overpaying for monthly internet service but don’t opt to switch to a more affordable plan that cost less than $50/month.

This a very creative way to combat debt by giving you more money in your pocket each month that’ll go towards your debt payments.

6. Find Out Where You’re Wasting Money

I’ve got good news for you. If you want to utilize lowering your monthly payments on bills but don’t have the time to do it (or are just lazy) — you can use bill negotiation services like Rocket Money, BillTrim, or Hiatus.

These services help Americans save millions of money each month.

Instead of having to call each company you have a bill with, they will do it for you… automatically.

I decided to try it out this year and sent them my utility bills and Rocket Money really went to work and I saved $200 in 4 days.

Yep, that’s $200 that can go towards getting rid of debt.

Rocket Money found ways to lower my cable bill and cell phone bill and canceled useless subscriptions I was paying for.

I wrote about the process in a review of the free service, but overall you just sign up and submit your bills and they get to work.

If you are at all interested in saving money, you should be using apps like Rocket Money.

#1 Money Saving App

Rocket Money

4.5

Rocket Money is free to use

Rocket Money helps 3.4+ million members save hundreds. Get the app and start saving today. Save more, spend less, and take back control of your financial life.

7. Ignore Online Scams

There is nothing more embarrassing than falling for the online scams that claim you can earn thousands of dollars a month by clicking a link and investing a couple of hundred dollars.

Similar to fad diet pills and daily fantasy sports, very few ever make a cent, let alone a living!

What a joke! Don’t fall for this.

Becoming debt-free takes time, patience, and discipline, so instead of investing your hard-earned cash into what adverts call “online deals”, use the extra checks to pay off debt fast.

Every dollar you can manage to save is a dollar you can use to pay off debt. Use those dollars to your advantage.

8. Saving Money While You’re Paying Off Debt

Should you save money while paying off debt? The short answer is—it depends. But, if you don’t have money set aside for emergencies and irregular expenses, you need to focus first on saving.

Drive used cars, try to live rent free, and don’t succumb to the constant urge for the latest and greatest gadget.

But how can you focus on saving money while also prioritizing paying off your debts fast?

One thing most people use is finance apps in order to help with saving money each month.

For example, building your savings is simple with the SoFi app.

SoFi offers personal finance tools to help you spend, save, and invest all with one app. SoFi lets you grow your money with a high-yield online checking account and earn 33x the national average.

Plus, you can pay down high-interest debt with a no-fee personal loan, refinance student loans, or automate your investing with SoFi Invest.

And you can connect thousands of financial institutions to SoFi Relay — free tools and trackers that help you organize and optimize your finances. Whether you choose to use all of SoFi’s personal finance products or just one, this ultimate personal finance app can help you make the most of your money.

If you are at all interested in saving money while paying off debt, you should be using the free SoFi app.

Earn $325 bonus

SoFi Checking & Savings

4.5

Bonus: $325 with direct deposit

- Up to $325 welcome bonus for new accounts

- No minimum deposit requirements

- No monthly account fees

- Competitive rates of up to 4.50% APY

- Direct deposit amount must total $5,000 or more within 25 calendar days to receive $325 bonus

9. You Can Use Debt Consolidation

Debt is rarely a simple, linear process. It’s a snowball effect, and if your finances are lacking in one area, chances are those issues will bleed into the next in an uphill battle.

The money you owe starts spreading to all corners of your life, to the point where you’re overwhelmed in simply managing it all.

Multiple lenders mean multiple waves of panics and headaches. Still, finding a way to lessen all the noise can make things easier. Debt consolidation is a great way to reduce your monthly expenses and reduce your overall debt.

Debt consolidation is another loan that will provide you with a single payment, which will cover all of your bills. The idea is that a single payment is much easier to manage than multiple payments.

And, in many cases, debt consolidation can provide you with a single more affordable payment. Consolidating debt can get a bad reputation, but it can also be useful. Your little problems might seem like one big problem if you do this, but that bigger problem is easier to keep track of.

If you utilize debt consolidation, there are fewer moving parts to attend to in managing your finances. Instead of attending to multiple people individually who all want their money back, you can go to one place to pay off all the debts in monthly installments.

With that being said, be aware of the common mistakes to avoid when securing a debt consolidation loan. In the end, it’s about perspective.

Related: Navy Federal Credit Union Debt Consolidation Review

10. Paying More Than The Minimum

First and foremost, you need to understand that paying more than the minimum on your debt payments is recommended.

Many people prefer simply paying the minimum. This is great if it is all that you can afford.

However, you should definitely pay more if you’re able to do so. After all, this is going to get the debt paid off much quicker.

It will also help you avoid being hit with those hefty interest rates. Just don’t overdo it.

Make sure that you stay within your needs or you may regret it.

11. Borrowing Against Your Life Insurance

If you have a life insurance policy with cash value, you should definitely think about using it to your advantage.

In fact, you should be able to borrow against your policy.

It is true that you’re going to be borrowing your own money. Nevertheless, it may prove to be most beneficial to you now than it would in the future anyway.

Just remember that you should repay it in the future.

After all, you’re going to want to make sure that your family will be well cared for after you’ve passed.

12. Get Out of Debt with Apps

Ah, the most common expression we digital junkies hear today. And, yes, there are debt payoff apps for virtually anything you want to do. That includes managing your money, getting out of debt and improving your credit score.

These apps really help you stay on top of your finances and help you find ways to get out of debt faster.

For example, Qube Money, is a free app that helps you manage your money, pay off debt and improve your credit score. It also gives you tips on how to budget by using the cash envelope system.

Qube Money takes the idea of cash envelopes and digitizes it. The app has been called ‘transformational’ and has even been featured on websites like Forbes. App statistics have shown that Qube Money users save an average of $440 per month.

Promo: ‘MEIGGS’ at checkout for 8 weeks of premium free

Qube Money

Qube Money offers affordable rates (including a free basic plan for individual users) and a host of useful features, which makes downloading this app a no-brainer. Budgeting doesn’t have to be complicated or unpleasant with this new budgeting app.

13. Consult Relatives And Friends

If you’re looking for ways to pay off a debt bill but are short some cash, you should think about consulting with your friends and family members.

There is a possibility that you know someone with a little bit of money. This individual might be interested in helping you.

If you get lucky, you might be able to borrow some money from your relatives.

This will give you the ability to get the debt paid down, without having to worry about missing payments or interest rates.

Nevertheless, you should still work diligently to pay back the debt. If you do not, you’re probably going to ruin your relationship with the individual in question.

Do you have an old phone lying around? I know most of my friends and family do. They don’t really care to try and sell them or are too busy.

Not me, I usually upgrade my phone once every two years and sell my old one online. I try not to wait too long after upgrading to sell the old phone because as each year passes, the fair market value of the phone, are losing value.

They lose value and can be sold for less as the technology becomes obsolete. Your best bet is to sell it immediately. You can try listing them on eBay or Craiglist, but this can prove to be quite the hassle. You can easily sell it using local selling apps and get cash. This is the easiest way to sell it quickly.

Don’t have an older cell phone to sell? It can be anything like clothes, DVDs, or old laptops. Here are some resources that can help you get fast cash for your unwanted junk:

15. Adjust Your Tax Withholdings

You can look into increasing your withholdings so that you get more in your take-home pay each week. Most people still wonder if they should claim 1 or 0 on their W-4, but some people don’t know they are able to claim more to have less tax being withheld.

You don’t have to pay anything extra by claiming more allowances on your W-4, and you’ll boost your take-home pay on each paycheck. The money withheld from each paycheck will be due come tax-time.

This is a smart way to use the extra money from your check to pay off your debt. Make sure you are claiming the correct amount of allowances allowed to get the least amount of taxes withheld. Stop giving the government an interest-free loan and use the money to get out of debt faster.

15. New Bank Account Sign-Up Bonuses

Ever get those flyers in the mail from Bank of America offering you a few hundred for opening up a bank account? Those may be worth looking into.

I love banking bonuses, and here are some that are available to you right now:

Best for checking

Best for savings

16. Get a Part-Time Job

If you find your budget depleting quickly and your debt out-of-control, you should consider getting a part-time job.

You can find legit part-time weekend jobs that will provide you with additional cash that can be applied to any debt balances you owe on loans, credit card debts and mortgages.

As mentioned earlier, instead of paying the minimum payment, you should consider paying a little extra, even if it is only $10.

This will help pay off your debt quicker and save you a little money on interest.

17. Earn More Money

The great news is that you don’t have to go out and find yourself a second job to try and make extra money with lucrative side hustles popping up.

In fact, this is something you can do in your spare time and from the comfort of your own home thanks to the availability of high-speed internet.

You can set up a home office with ease from which you can do your work in peace. Here is a list of ways to make some extra money. There’s something on the list for everyone, so find something you enjoy and start earning some extra cash.

Or you can learn more about how to use side hustles to pay down debt below.

Ways to Make Extra Money to Pay Off Debt

If huge credit card debt or student loans are taking a toll on your personal financial life, then you can benefit from some lucrative side hustles. Side hustles play a significant role in helping to generate some extra money so you can pay off debt aggressively.

If the income that comes from your full-time job is just not enough after making other necessary expenses (not shopping), then you can think of a side hustle to make progress on your debt payoff goal.

You can continue with your mainstream job while considering a side hustle, it can be freelance writing, promoting good quality products, paid online surveys, gig jobs, part-time weekend jobs, pet sitting, etc.

Just keep in mind that if you don’t start budgeting or overspending, then nothing will be enough for paying off your growing debts.

If you need some ideas we have reviewed a lot of money-making side hustles:

Best Side Hustles Reviewed

DoorDash Driver Review – Signup Today & Start Dashing

Every completed delivery puts money in your pockets. Fast approval process. Work when you want. Use any car to deliver or bikes & scooters also accepted. Get paid the same day and earn all tips and easy signup.

DoorDash Driver

5.0

Earn extra money for your short-term or long-term dreams with DoorDash. As a Dasher, you can be your own boss and enjoy the flexibility of choosing when, where, and how much you earn. All you need is a mode of transportation and a smartphone to start making money. It’s that simple.

Swagbucks Cashback Review (& Surveys)

At Swagbucks, you can earn free gift cards or cash via PayPal when you shop online, watch videos, take surveys, and discover deals and promo codes. It has paid over $150 Million paid to members.

Earn around $50 to $1,000 per year

Swagbucks

5.0

Swagbucks offers a variety of ways to earn money online. You can take surveys, play games, surf the web, watch videos and more to earn points towards gift cards or cash.

Survey Junkie Review – Get Paid for Sharing Your Opinion

Survey Junkie is one of the best paid online survey sites that pays cash via PayPal. Join 8,145,798 active members that take surveys as a side hustle. Free cashout and you can earn anywhere. You can also make money with focus groups, web interviews and trying new products from your favorite brands.

$1.6M+ monthly payout to its members

Survey Junkie

4.5

Over $55,000 Paid to Survey Junkie members daily

Survey Junkie is one of the highest-paying survey sites available. Complete three or more surveys a day, and you can earn as much as $100 monthly. With $76 Million paid out to date, Survey Junkie is one of the best survey sites available.

Whatever it is, make sure you do the side gig wholeheartedly and get a good amount of money.

Once you have started making extra income, it is important to know how to use that extra money properly to pay off your debt fast.

Tips on Using Side Hustles to Pay Off Debt Fast

Here are some vital tips on using side hustle in the best way for debt repayment purposes.

Extra Income Doesn’t Mean More Spending

Having some extra money can be enticing to get a spending spree. If you think you have more money, so it can be okay to spend some money on your wishes, then you are digging into dangerous financial problems further.

Once you are earning more money you shouldn’t increase your expenses, especially when you want to pay off your debts.

The whole extra income is for the debt repayment. So, revisit your budget and cut down on every unnecessary expense. Doing so, you will notice some extra money will start flowing in.

So, no need to use your extra income for your own expenses and you can freely use the income from side hustles for making debt payments.

Stay Motivated With Your Efforts

To get rid of your debts with the help of the side gigs, you must choose a work that you love to do; otherwise, you may feel stressed out due to the burden of work.

It is recommended to consider a side hustle that is related to your interest.

For example, if you’re an expert in writing, then freelance writing would be the best side hustle for earning some extra income.

Or, if you love pets, then pet sitting with Rover can be the perfect choice to feel relaxed while earning a good amount.

Decide a Debt Payoff Strategy

A side hustle will help you to earn decent money. But unless you follow a proper debt-repayment strategy, simply making extra payments will not work.

Target a debt that you want to pay off first. In terms of the debt pay-off strategy, you can go for the debt avalanche method, which can be done by yourself by targeting the highest interest rate debt while making minimum payments on the other debts.

If not the avalanche method, then you can choose the debt-snowball method, where you need to target the lowest balance first while making the minimum payment on the rest of debts (my favorite method).

If you don’t want to bang your head on any DIY debt repayment option, then you may consider debt settlement program as well or consolidate your loans.

Whatever the strategy is, make sure the extra debt payments are being applied properly so that your burden gets reduced soon. And to successfully fund the debt repayment goal, you need to manage your extra income properly by using budgeting apps.

Set Up Automatic Transfers

Missing a single debt payment while you’re on a debt payoff goal can spoil your whole effort. To avoid a debt payment or spending money on something else, set up an automatic transfer from your checking account.

This reduces your stress and helps to assure you that the payments are sent on time. Thus, you will no longer be charged any unnecessary hassles related to making debt payments.

Set up an automatic payment to happen right after you get paid from your side hustle.

Choose the Right Side Hustle

Make sure the side hustle consistently provides you with an income each month. The income from freelancing or side hustling often fluctuates month to month.

You may end up with $0 one month and make $500 the next. So, you have to be prepared for cutting down your expenses. Otherwise, you may not be able to make the debt payment successfully.

Learn From Your Past Mistakes

Considering side hustle can be a good strategy for destroying debts. However, you should be careful not to accumulate further debts in the future.

Remember, earning extra money doesn’t always guarantee that you will be able to become debt-free every time you fall into debt.

You shouldn’t repeat the financial mistakes (using credit cards randomly, not paying the bill on time, living a lavish life) that invite debt.

Lastly, getting rid of debts with the income of a side hustle is possible. A lot of people are doing it and getting good results. You can give it a try.

But, you need to put extra effort into choosing a profitable side hustle that can help you generate a good income side by side.

On the other hand, make sure you review your monthly budget and your expenses from time to time and make some lifestyle changes on your way to becoming debt free forever.

The Goal for a Debt-Free 2023

Debt. It is almost a universal circumstance. We have student loans; we have car loans; we have credit card debt; we may even have some personal loans that were the result of past emergencies or other needs.

Now, we find ourselves making several payments every month, hoping we don’t forget them, and wondering how we can ever see an end to these minimum payments and high-interest rates.

If this is you, then you need to organize the management of your debt and then use these steps to help you pay off your debt fast. After all, the goal is to make your debt disappear as quickly as possible, have an emergency fund, and reach your financial goals.

However, there are support services for low-income families all across the United States if you really need it.

Federal assistance lifts millions of people, including children, out of poverty and provides access to affordable health care.

Best of luck to those wondering how to pay off debt fast!