Whether you want to consolidate your credit card debts, pay off big expenses, or simply need money now, it can make sense to compare the best personal loans or just use a cash advance app.

But if you’re looking for a personal loan, you’ll definitely want to consult a variety of lenders to get the best rates and terms. We recommend these lending partners based on what you’re looking for.

Featured

But if you’re in a hurry then we would recommend Upstart — which offers fixed-rate loans with no origination or prepayment fees. You can get a loan from Upstart even if you have bad credit.

Checking your rate on Upstart will not affect your credit score. When you check your rate with Upstart, they make a soft credit inquiry. Plus, there is no prepayment penalty for paying off a loan on Upstart early.

You may pay off part or all of the loan at any time with no fee. By prepaying, you will pay less overall interest because the loan is outstanding for a shorter time.

Featured

Upstart

5.0

Rate: 5.40-35.99%

Loan amount: $1,000-$50,000

Min credit score: none

- Accepts borrowers new to credit.

- Able to fund loans one business day after the borrower accepts a loan offer.

- Offers direct payment to creditors with credit card consolidation loans.

- Allows borrowers to choose and change payment date.

- May charge an origination fee.

- Borrowers can choose from two repayment term options only.

- No mobile app to manage a loan.

Simply compare other leading lenders in the table below.

Best Personal Loan Option If You Have Bad Credit

Just remember that if you actually need money now, then you can opt for a personal loan. When you need money in a hurry ZippyLoan is where to go.

You apply for a loan through the Zippy Loan site, if approved they send your loan application to one of many loan providers.

You review the loan details and e-sign if you like what you see. No risk in checking what offers you’ll get. You can borrow between $100 and $15,000 as soon as tomorrow.

Loans service up to 60 months.

ZippyLoan connects borrowers to lenders through their network of lenders. They’ll find you the lowest interest rate and is one of the best no credit check loan. You can visit ZippyLoan here.

Fast Funding

Zippyloan

4.0

- Borrow between $100 and $15,000

- No risk in checking what offers you’ll get

- Quick approval and fund disbursement (if approved)

- No minimum credit score requirement

What are Personal Loans?

Personal loans become part of everyone’s life at one point or another and nowadays, direct lenders are on every page of the internet offering you the best deals.

But it’s for good reason.

A personal loan could be used to:

…& so much more.

There are some types of personal loans which gained more popularity than others due to their several benefits, but this doesn’t mean they’re right for you.

Find out what types of loans you can find on the market and which ones better suit your needs.

Fortunately, a personal loan from a reputable lender can be a low-cost solution when you need to borrow money. You can learn more about personal loans here or keep reading for more information about whether a personal loan is right for you.

Secured Loans

Secured loans are typically backed by collateral, like your vehicle, house or some other assets which you pledge to the direct lender in exchange for a loan. The advantage of these types of loans is that they usually have lower interest rates and are easier to obtain since they are less of a risk due to the collateral.

The disadvantage, however, is that the other important criteria to get approved will be your Credit Score, which needs to be somewhere in between 580 – 739 or higher. In case you have a bad credit situation, you’ll most likely not going to get a secured loan. If your credit score is on the lower end, you can easily improve it in just 5 easy steps or check out personal loan options for those with bad credit.

Unsecured Loans

Unsecured loans are not backed by collateral, therefore, they tend to have higher interest rates. The main factor to get approved for an unsecured personal loan is your Credit Score. Direct lenders became more flexible with time, so if you’re lucky and dig a little deeper, you’ll find reputable companies which will do their best to get you approved for a loan.

For example, MoneyGator.net is an online direct lender that offers short-term installment loans and apart from your credit situation, they will ask if you have a secure monthly income source, or if you’re employed – just so they can have a proof you can pay off what you borrow. Also, they discuss with you the repayment schedule so the installments will meet your needs and financial possibilities and they don’t charge extra in case you want to make pre-payments, this is an advantage which can have a huge impact on your overall pay off process.

Different Types of Interest Rates

Fixed-Rate Personal Loans

Fixed-rate personal loans are the ones that carry fixed rates and monthly payments. They are a great choice if you allow a certain sum of money from your budget to the monthly pay off process.

At some point, you might find their lack of flexibility very inconvenient, so it is one thought-provoking disadvantage. Just a tip, it’s always a better choice to opt for more flexible lenders.

Variable-Rate Personal Loans

Variable-rate personal loans have interest rates connected to the benchmark rates, also known as the index rates, which are set by banks. As a result, your monthly payments, as well as their interest rates, will follow their course.

Depending on the economic condition, this can be a good thing, as index rates tend to have a lower APR (Annual Percentage Rate) when they go down; it allows you to pay off your loan balance at a lower cost. However, when the index rate rises, that means your loan balance cost will grow as well, which can be very … pricey!

Loan Repayment Terms

If you’ve never been one to borrow money, you’re probably not familiar with all of the available loan options out there such as short term loans and long term loans.

Short-Term Loans

Short-term loans typically involve borrowing a small amount of money over a short period of time (a few months up to maximum one year). They are the best solution if you’re dealing with a financial emergency or you’re in need of some extra cash.

They are fast, flexible; it takes only a few minutes to get approved by the online direct lenders and they have a lot of other benefits. However, you should be careful as some short-term loan types have very high interest rates, for example, payday loans, which can lead to bigger financial problems.

Short term loans are the most common for individuals. However, they are available to businesses as well. Even if you aren’t approved for a major personal loan, most times, you can still pursue a one-time, short term loan to get your hands on much-needed working capital.

Long-Term Loans

Long-term loans are credit based and they can be secured or unsecured. They can be taken over a bigger period of time (one or more years).

The most common from this category are student loans, mortgages or wedding loans.

How to Improve Your Credit Score with a Personal Loan

Thinking about taking out credit building loans? Here are some easy steps to follow so you can use personal loans to build credit.

One of the easiest ways to get instant cash is by opting for a personal loan. Unlike other loans, personal loans generally don’t require security or collateral. The documentation and approval processes are also smooth and hassle-free. Moreover, you can use the amount for anything you want – for planning your wedding, for medical purposes, for a vacation, or for renovating your home.

However, defaulting on a loan could adversely affect your credit score. Let’s look at some of the ways how applying for a personal loan can help you improve your credit history.

Personal Loans Can Be Used to Pay High-Interest Rate Loans

When you have a high-interest loan, it could be difficult to repay the amount every month. The two common financing options people opt for are personal loans and credit cards. People generally shy away from taking a personal loan as they are known to come with high rates of interest. However, they are still a cheaper alternative to credit cards.

When you have more than one credit card, you will have to pay a high rate of interest on the outstanding amount of all the cards. Even if you opt for a credit card that comes with a 0% balance transfer plan, you will have to finish paying off the amount during the introductory period. Once the introductory period is over, the interest rate will shoot up to a two-digit figure.

When you use the personal loan amount to finance a high-interest loan, you not only reduce the burden on your overall finances but also improve your credit score immensely. Due to competition from fellow banks, you will come across some banks offering personal loans at attractive rates. Generally, the banks with which you have an account already will offer loans at great rates. You could also get a pre-approved loan!

Can Be Used to Consolidate Debt

One of the common financial problems most people face is accumulating different debts and not being able to pay them off. Even if you have more than one credit card, it will be difficult to pay the debts and also your cards’ soaring interest rates. Moreover, with many debts to pay off, at some point there are chances you could miss repaying maybe one or two of them. Yes, you have the option to make the late payment charges, but your credit score has already been affected with the delayed payment.

Instead of paying debts with different interest rates, you could opt for a personal loan. The financing amount can be used to consolidate your total debt and you could pay off the amount until the end of the tenure. It saves you from the hassle of missing payments as you have consolidated all the payments into one.

Can Help in Establishing a Credit History

Companies that check an individual’s credit score assess different parameters before giving a score. The individual’s payment history is one of the most important factors which is considered. The other factors include the total amount owned by an individual, the duration of the credit history, new credit as well as credit mix. But what If you don’t have a credit history at all?

Not having a credit history is just like having a bad credit score. You need to establish a credit history so that banks and financial institutions know your creditworthiness and your ability to repay them. There are several ways to create your credit history, one of the ways is by applying for a personal loan. However, you must ensure to make your loan repayments on time, as loan defaulters get a bad credit score.

A Few Tips to Keep in Mind When You Apply for a Personal Loan

Go Through Your Credit Report

No matter if you have defaulted on a payment or have applied for too many loans, you need to go through your credit report. By analyzing your report, you will be able to know the areas you need to work on and look for ways to improve the score. While applying for a personal loan can help to a great extent, there are many other factors that could increase your score. Understand the available options and work towards building a good credit history.

Make Your Loan Payments on Time

Did you know that late payments will stay on your credit reports for years? Banks and other lenders go through an individual’s credit report when they offer financing. If they come across late payment, they will doubt your creditworthiness. Even before applying for the loan, learn how to manage your finances properly so that you don’t have to struggle with the additional burden.

Don’t Apply for Multiple Loans

A bank will know how many loans you have applied for and how many times you have applied for a loan. This is because whenever you approach lenders for loans, it will be recorded in your credit history. This may give the impression that you have poor repayment capacity and your application could be declined. Even if you manage to get more than two or three loans, you need to see if you will be able to manage your monthly expenses properly before opting for a loan again.

Borrow What You Actually Need

One of the mistakes people make is applying for a higher loan amount than they actually need. You end up paying a high interest rate for the entire amount, including the amount you didn’t require in the first place. Apply for an amount you actually need to meet your short-term financial goals.

Compare Loans Offered by Various Banks

All prominent banks across the world offer personal loans. However, you will come across some banks with better interest rates than others. Before applying for a loan, do your research and compare the loans offered by different banks. Then, shortlist the ones which come with the least interest rates. Also consider the tenure of the loan, the other fees and charges you need to pay, and the total amount of financing.

Have Bad Credit?

Short term loans can be rather useful, especially when you’re in a financial pinch. Whether you have an unusually large bill that needs paying immediately, you have a vacation coming up, or you’d like to put a down payment on a new car, short term loans can be your best option even if you have bad credit.

How Many Types of Short Term Loans Are There?

If you find yourself considering applying for a short term loan, you’ll want to be as informed as possible before making any final decisions. As with most financial options these days, there are several types of short term loans available to the general public.

Here are but a few of the most popular forms of short term loans to apply for.

Cash Advances

One of the most popular short term loan options comes in the form of cash advances. Most times, cash advances are small amounts of money and require repaying within a couple of weeks. Sometimes cash advance repayment may be extended for up to a month or two.

Installment Loans

For those who find themselves in need of a bit more cash than what a basic cash advance allows may consider a short term installment loan. The main difference between a cash advance and an installment loan is that installment loans require smaller payments over a longer period of time. Typically, they also have less interest attached to the payments than cash advances.

Bad Credit Loans

Last but not least of the most popular short term loan options are bad credit loans. These loans normally come with pretty steep interest rates even in comparison to cash advances. It is not recommended to take a bad credit loan unless it is absolutely necessary.

Best Short-Term Cash Advance Apps

When it comes to taking out a payday loan, there is no question that it can be beneficial if you need money in a hurry. You’ve probably seen payday loan stores or online ads for cash advances at some point in your life.

Whether you need money to cover an expense to avoid overdraft fees or just need access to money in a rush, these cash advance apps can help you get paid today.

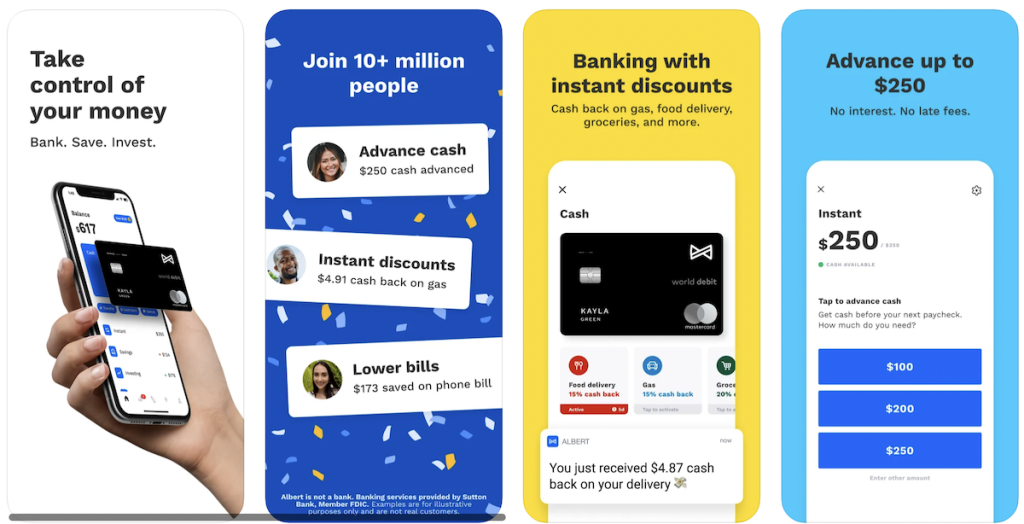

Albert: Best All in One App

Albert can spot you up to $250 so you can make ends meet. No late fees, interest, credit check, or hidden hands in your pocket. As long as you have a paycheck and have repaid your past advances, you can request up to 3 cash advances per pay period.

Albert is a super app that offers:

- Checking account with debit card: Offers a $150 sign up bonus

- Savings account: Set your schedule or let Albert analyze your spending and automatically move money into your savings account. (On average, they save people $400 in the first six months.)

- Cash advances: Up to $250

- Investing: Invest yourself or enable Robo investing

- Budgeting: AI-driven auto save feature is a big differentiator and very effective

- Genius: Text with a certified financial advisor anytime for a $6/month fee

There’s no catch. Albert is legit and is also giving away a $150 cash bonus to new members and another $150 bonus for every person you refer to the financial advisor service.

Get up to $250 and $150 welcome bonus

Albert

- Get a no-fee and interest-free cash advance of up to $250

- Pay a small fee to get your money instantly or get cash within 2–3 days for free

- Costs $8 per month after a 30 day free-trial

Where to get it?

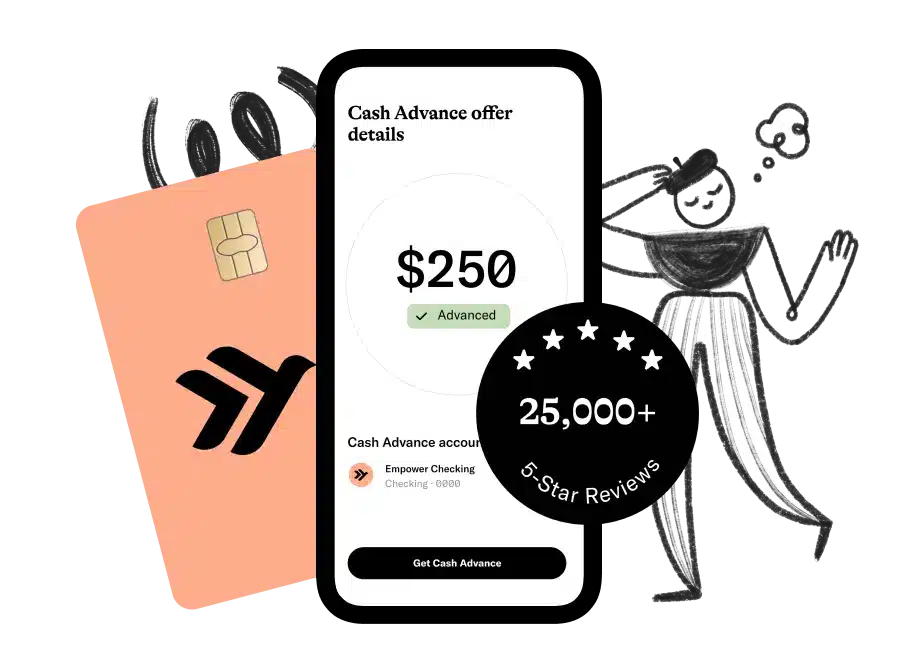

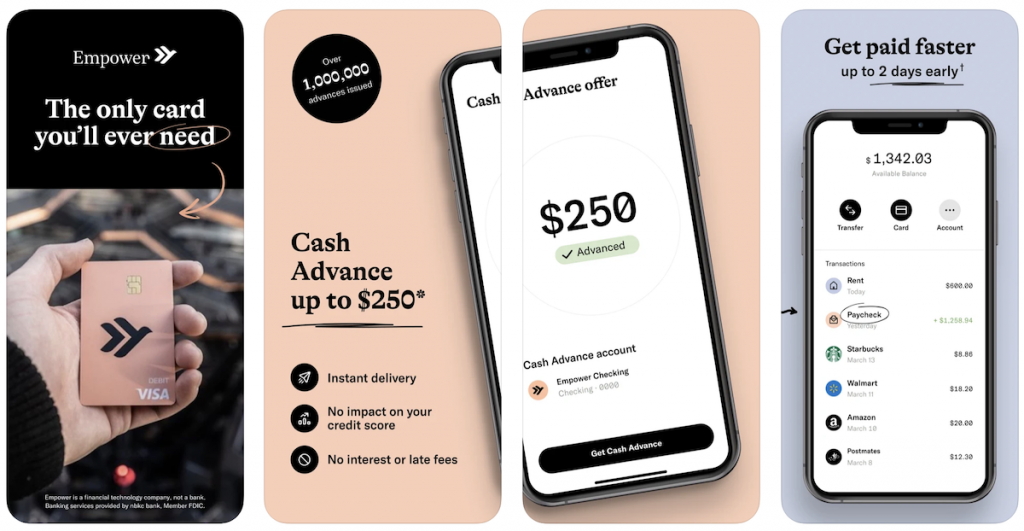

Empower: Best for Cash Advances

Empower is an application built for today’s generation. They’ll be there for you every step of the way, whatever comes your way. You may get a cash advance of up to $250 when you need it most by downloading the app, and save for your future.

They’re always there for you, and they’ll get a cash advance up to $250 straight into your bank account. Free instant delivery is available for eligible Empower Checking Account customers with an activated debit card.

To determine if you’re qualified to receive a Cash Advance, Empower calculates your bank account history and activity, recurring direct deposits, and average monthly direct deposits.

There are no applications, interest or late fees, or credit checks or risks involved. You simply reimburse them as soon as you receive your next payday. There’s nothing hidden about it. It’s that easy.

Get up to $250

Empower

4.5

- Get a no-fee and interest-free cash advance of up to $250

- Use AutoSave to automatically set money aside every week

- Costs $8 per month after a 14-day free trial

Where to get it?

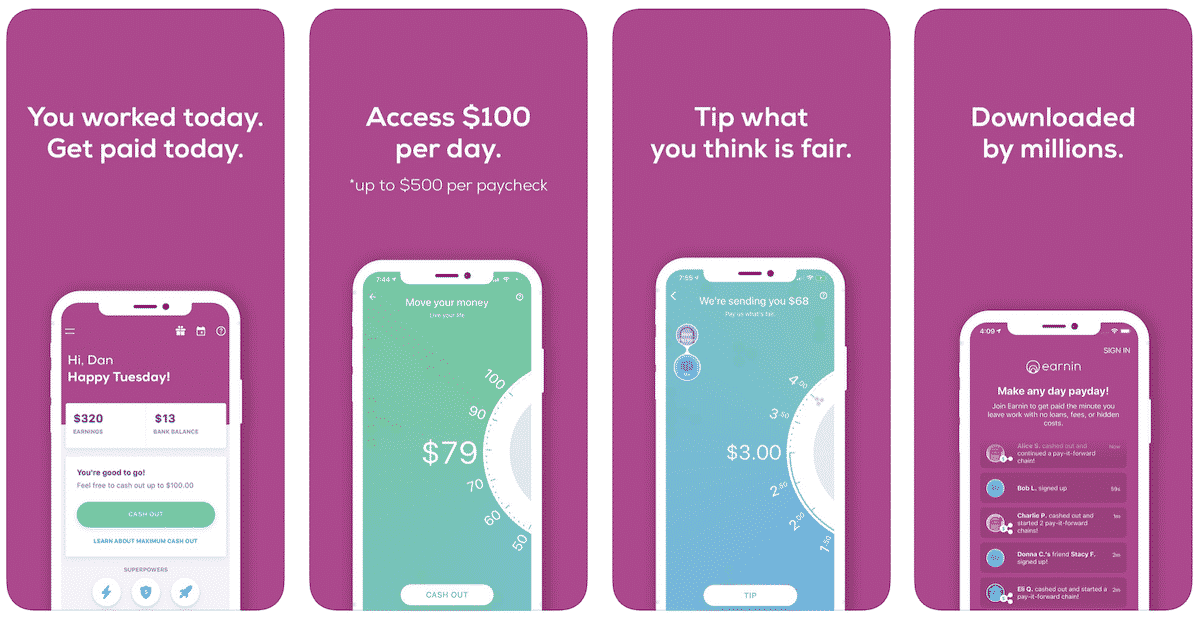

Earnin App: Best for Workers with Hourly Wages

The Earnin app allows you get paid today and access $100 per day, up to $500 per paycheck. The app is free and you only have to pay what you think is fair and millions already use this app to get paid today.

How Earnin works:

- Connect your bank and tell them where you work.

- Earnin will confirm your hours worked, and you can cash out those hours instantly.

- On payday, they will debit your account for the money you cashed out.

You can also set up Lightning Speed by connecting your debit card to your Earnin account and eliminate the wait time between your cash out and the money arriving in your bank account. The best part is that it is all 100% free and you can learn more here.

Get up to $500

Earnin

4.5

- Access to your hard-earned cash right when you need it

- No hidden fees, no penalties, no waiting

- Get up to $500 of your paycheck per pay period

Where to get it?

Best Short-Term Installment Loans

PersonalLoans.com

PersonalLoans.com is another option and offers installment loans from $500 to $35,000. So if you need more money, this would be your best bet. Like the other installment loan options, all credit types are welcome.

They have a wide variety of lenders in its network that offer competitive rates and is available in all 50 states. Personal loans can be used for whatever comes your way — you can use the loan proceeds for any purpose and you can get funded as soon as one business day.

No hidden fees. No upfront cost. Zero obligation. Review your loan offer before accepting any funds, hassle-free.

Quick Funding

PersonalLoans.com

Our online form is easy to complete and can get you connected with funding options in minutes. If approved, you can receive your funds as soon as the next business day. No hidden fees. No upfront cost. Zero obligation.

BadCreditLoans.com

Bad Credit Loans offers installment loans from $500 to $10,000 and has been in business since 1998. They help those with bad credit by connecting them with different lenders. They offer a quick application process and quick funding as soon as the next business day.

Bad Credit Loans is a free, for-profit organization that provides free information and connects consumers with a network of lenders who are prepared to give no-obligation offers.

The site’s extensive news section warning customers about new scams, best practices for rebuilding and taking out debt, and a variety of other services make Bad Credit Loans a useful resource for those in need of cash.

Complete the online form on their website and its network of lenders will determine if you are eligible for a loan offer. If you’re approved, just review and accept your loan — all online!

Request up to $10,000

BadCreditLoans.com

Every day, Bad Credit Loans helps people looking to secure a loan, obtain information about debt relief, credit monitoring and other solutions to meet their needs.

The Bottom Line

Remember! Requesting and getting the money you need is that easy, however, when it comes to borrowing money you must always do it responsibly!

Keep in mind that quick personal loans, such as short term loans, carry a higher interest rate than conventional personal loans. This is because they are considered risky loans since they are approved without taking into account the credit history of the applicant.

So if you’re looking for the best short term loan to suit your needs, consider the options listed in this article and you’re guaranteed to find it. To sum up our personal loan guide, there are numerous possibilities out there, the first step is to identify your needs, financial possibilities and find a lender which will understand them as well. The road to a debt free life can be easy if you make it!