Life is full of unexpected expenses, no matter how well we prepare. Having access to funds in an emergency can help bring your stress levels way down. That’s where a cash advance comes in.

At the same time, most cash advances come with hefty fees and strict repayment terms. If you do have to take advantage of this resource, you’ll often pay a steep price.

That’s not always the case with cash advance apps. In fact, these apps won’t subject you to the same fee structures and repayment terms most other cash advance opportunities do.

Many of them work with you to provide a valuable service if you’re ever in need. Plus, they can also help you stay on top of your finances by tracking your spending and setting up a budget.

These cash advance app developers know that it’s about much more than lending money; it’s providing a handy service when you need it. If you’re not sure what cash advance apps are right for you, though, you’ve come to the right place.

Our list of cash advance apps includes many with varying terms and conditions to fit your lifestyle. No matter what you need a cash advance for, these apps are here to save the day.

Are you ready to find out what the best cash advance apps are? Let’s get started.

Best Cash Advance Apps

The following cash advance apps are all available on the App Store and Google Play Store for download.

|

Get up to $750 paycheck advance |

|

|

|

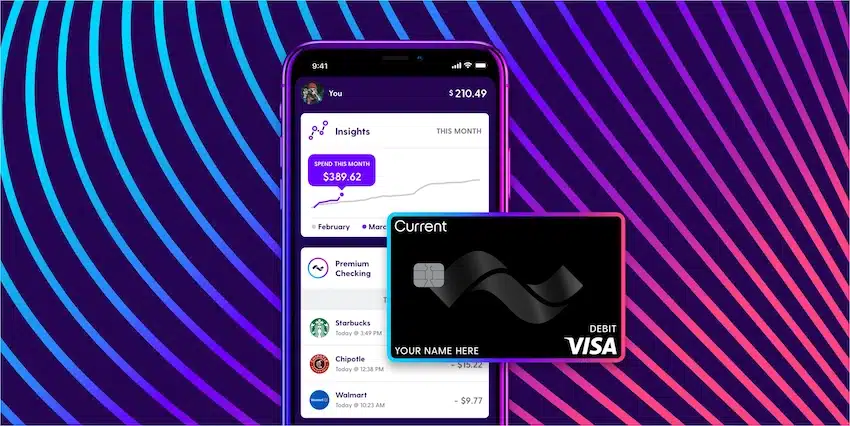

1. Current (Get up to $500)

Current is a financial technology company offering modern banking services through its mobile app. By signing up you can get paid up to two days early, with no minimum balances or hidden fees. Plus, there’s no credit check, so your credit report stays untouched.

With Paycheck Advance, you can access up to $500 from your next paycheck before it arrives. To qualify, just ensure you receive at least $500 in payroll deposits into a Current account or a linked external account.

We love that this feature doesn’t involve credit checks or affect your credit score and everything is 100% free without any fees.

Get up to $750

Current

5.0

- Get a paycheck advance of up to $750 without a credit check

- Unlimited access, advance as much as you qualify for, as often as you need

- No minimum balance or hidden fees, 100% free

- Claim a $50 bonus with code WELCOME50 and a $200+ deposit in 45 days!

2. Albert (Get up to $250)

Albert is a financial services app that helps users save, spend, borrow, and invest. It offers banking services and you can request up to $250 instantly without a credit check.

Albert offers most of its services for free, but its premium Genius service costs $14.99 per month or you can try it for 30-days free.

Get up to $250

Albert

4.8

- Get spotted up to $250 instantly

- Pay a small fee to get your money instantly or get cash within 2–3 days for free

- Costs $14.99 per month after a 30 day free-trial

3. Brigit (Get up to $250)

If you have a low balance in your checking account, Brigit will see that your balance isn’t enough for upcoming expenses and send you up to $250 to cover your expenses. You can save hundreds by avoiding overdraft fees with this app.

Download Brigit on either your iOS phone or Android device to have the chance at up to $250 in cash advance funds without a single credit check.

Plus, you won’t pay interest on your advance or any hidden fees. Check out Brigit to see what else the cash advance app can offer you.

Get up to $250

Brigit

4.0

- Tap to get an advance within seconds

- Get up to $250

- No credit check is required and no interest

- Pay it back without hidden fees or “tips”

4. Cleo (Get up to $250)

To access up to $250 in cash advance funds, you’ll need to subscribe to Cleo Plus. It will cost you $5.99 per month but you’ll have access to cashback rewards as well.

Cleo lets you choose your repayment timeframe, from three days to 28 days. Plus, your cash advance won’t affect your credit score.

If you don’t want to pay for access to a cash advance, the basic version provides free tools for managing your money.

These include a budgeting tool, a digital wallet, and a weekly quiz you can take to earn cash rewards. Cleo also lets you earn interest on your savings as well.

Get up to $250

Cleo

4.0

- Borrow up to $250 instantly with no credit check or interest

- Personalized tips on how you can save more

- Get help creating and sticking to a budget

- Costs $5.99 per month for Cleo Plus

5. Klover (Get up to $200)

You’ll need to have at least three consecutive direct deposits within the last two months, with no gaps in pay with the same employer, to qualify for a cash advance of up to $200 with Klover.

Though this app doesn’t offer a whole lot beyond the simple cash advance framework, it’s a powerful tool you can use to cash in on a cash advance.

6. MoneyLion (Get up to $250)

MoneyLion works with Instacash to get you up to $250 with no interest or associated fees.

You can apply for a MoneyLion account online, but you’ll have to link your checking account to qualify.

There’s no monthly fee with a MoneyLion account. You can get paid up to two days early with RoarMoney.

Plus, the platform offers several ways to borrow, invest, earn, and save. You’ll never complete a credit check either, keeping your score intact.

Get up to $250

MoneyLion

4.5

- The maximum advance is $500

- No interest. No monthly fee. No credit check

- Link your checking account to qualify for 0% APR cash advances

- No monthly fee for Instacash

How are Cash Advance Apps Different

Cash advances are sums of money taken from your pending paycheck to help you offset expenses. The most important characteristic of cash advances is that it’s your own money you’re borrowing, you just haven’t received it yet as the bank is still clearing the deposit. They can also be funds you borrow against your credit limit, albeit with a price.

Yes, cash advances do have caveats. If you initiate a cash advance through your credit card, you’ll pay higher APR fees than you would for traditional credit card balances. In addition, you may be subject to transaction fees and other charges along the way. The idea is that creditors are willing to lend you this type of emergency money, but not without paying the price.

Cash advance apps, on the other hand, provide a similar (if not better) service without all the unnecessary fees and repayment term restrictions. You’ll still have access to your funds (whether via paycheck or credit card) early, but you’ll pay zero interest in most cases. While these repayment terms last only so long in most cases, they can really help you get a leg up when you need it most.

In contrast to payday and personal loans, cash advance apps incorporate shorter repayment schedules into their fine print. In most cases, your repayment balance comes out of your direct deposit as soon as it hits your account. At the same time, some people may find this type of arrangement preferable to creditors who don’t care how much you rack up in expenditures. You’ll also receive your funds quickly, typically within 2-3 business days at most.

Pros

Here are some of the best features of cash advance apps:

- Receive the money you rightfully earned quickly

- Costs less in interest payments than payday loans

- Won’t negatively affect your credit score

- Zero-interest terms can help you pay back the advance without any interest

Cons

You should also consider the following if you’re contemplating using a cash advance app:

- It’s not a good idea financially to spend what you don’t have.

- Misuse of cash advances can exponentially increase your debt.

- It’s still possible to overdraft your account, even with a cash advance.

FAQs

The best cash advance apps are those that suit your needs. Features of the best cash advances include zero-interest terms, higher advance limits, and plenty of financial tools to get back on track.

Some cash advance apps offer interest-free loans, but these loans may come with other fees or a suggested tip. For example, some $100 loan instant apps such as Cash App charges interest of 5% of the borrowed amount, and must be paid back to the app within four weeks.

The best type of loan or advance for you will depend on your individual situation. However, you can expect lower interest rates and more flexible repayment terms with a cash advance, whereas personal and payday loans are more restrictive in their approach.

Get a Cash Advance on Your Paycheck

We hope you’ve found this article useful in finding out how you can take out a cash advance on an app without agreeing to high interest rates and long repayment terms. That’s why many individuals choose to download and use a cash advance app over payday and personal loans.

The best cash advance apps, however, are those that ensure they’re simply one part of the financial journey their members are on. They often provide financial resources members can take advantage of to get back on track and provide a brighter financial future for themselves. How will you use your new knowledge of cash advance apps to achieve your financial goals?