Not all bank accounts are the same, especially when it comes to promotions. While the basic process of opening a bank account remains similar across the board, sometimes eligibility for corresponding promotions requires a direct deposit.

For anyone who doesn’t have access to this, it can be difficult to find a bank account that doesn’t require direct deposit to earn a bank bonus.

If you’re stuck wondering which banks will reward you even when you don’t have direct deposit, you’re not alone.

This is especially true for a time like the present when more and more people are choosing self-employment over traditional employment.

Perhaps you’ve got a traditional job, but you’re paid in cash or by check instead of direct deposit. Whether or not your employer offers direct deposit capabilities, you should (and do) have access to bank accounts that don’t require this.

In fact, our list below includes 24 banks that don’t require you to have direct deposit in order to (a) open an account and (b) earn promotional rewards.

All you have to do is meet the guidelines, and the promotional bonus is yours to claim. You won’t have to worry about not having direct deposit to enjoy the benefits of a bank account either.

Are you ready to see which banks reward you without requiring direct deposit? Let’s get started!

25 Bank Promotions Without Direct Deposit Requirements

The list of banks below offers both accounts and promotions without requiring you to deposit funds on a regular basis.

There are plenty of other benefits to banking with these financial institutions, depending on which one you choose.

1. Acorns – $325 Bonus

Expires: February 4th, 2023

First on our list is Acorns, a bank that will reward you with a $325 bonus if you refer two friends using your personal referral link to open an Acorns Invest account.

These friends will have to make their first investment by February 4th, 2023 in order to qualify, in addition to a deposit of at least $5.

When you and your friends complete these requirements, your bonus will be deposited into your account within 30 days.

2. TradeStation – 50% off futures trading

Expires: Limited Time

Get 50% off futures brokerage fees – forever!

Apply your trading strategies on a customizable platform built to support advanced trading techniques.

And now get locked-in for 50% off futures brokerage fees by opening a new account using promo code FUTRAFZT.

Whether you trade stocks, ETFs, options, or futures, TradeSation’s award-winning desktop platform delivers the power, speed, and flexibility active traders demand.

3. Chase – $300 bonus

Expires: February 16, 2023

This is one of the better business checking promotions currently available from Chase. Simply maintain a minimum balance of $2,000 for 60 days after opening your new business account to earn $300 in bonus cash.

You’ll also need to make 5 qualifying transactions within the first 90 days and have those funds front and center within the first month.

Chase makes it easy to save for your business with the Chase Business Complete Banking℠ account.

You can open the account online or enroll in person by entering your email and receiving a promotional code.

Once you complete the requirements for the bonus, your bonus will be credited to your account within 15 days.

Related: Chase Bank Promotions and Bonus Offers

4. Revolut – 3 months of Revolut Premium free

Expires: Limited Time

You can easily open a Revolut account online and get Revolut Premium free for 3 months

Enter your mobile number and receive a unique link to download the app.

Follow the steps to open your new account.

Make your first payment, with a physical or virtual card to get 3 months of the Premium plan for free.

5. Upgrade – $200 welcome bonus

Expires: Limited Time

Open a free Rewards Checking Account and qualify for an Upgrade Card to earn a $200 welcome bonus from Upgrade.

The Upgrade card is a blend of a credit card and a line of credit that you can use for daily purchases.

In addition, you can use your new debit card to make three qualifying purchases to earn your $200.

Upgrade doesn’t require a direct deposit or minimum balance to open a new account. Plus, there’s no monthly maintenance fee.

Upgrade most often does a soft pull credit check, but they may perform a hard pull in some cases.

However, your $200 bonus should post within 1-2 billing cycles after your third debit transaction, so that can be helpful as well.

6. Axos – $150 bonus

Expires: Limited Time

Speaking of investments, you can also use Axos to open a Self-Directed account or a Managed Portfolio that offers commission-free trades.

If you want the $200 welcome bonus, you’ll need to fund your new account with at least $2,000 within 60 days. And if you’ve got a Self-Directed Trading account, you must complete at least two trades.

Once you do that, you’ll be eligible to receive your bonus within 30 days thereafter.

7. UFB Direct – $75 bonus

Expires: Limited Time

Sign up for a UFB Elite Savings or UFB Elite Money Market account to earn $75. All you have to do is enter your email to receive a unique code, open your new account, and fund it within 10 days.

You can redeem the $75 for a virtual Visa card or a gift card to some of the most popular retailers.

Plus, the account comes with a standard 3.16% APY. Your $75 bonus should come within 60 days of fulfilling the requirements.

8. NorthOne – $20 bonus

Expires: Limited Time

A Business Banking account with NorthOne does come with a flat $10 monthly maintenance fee.

However, you won’t pay for ACH payments, purchases, deposits, app integrations, or transfers.

It’s free to try this account for three months as well, as long as you fund your account with at least $1.

When you do, you’ll also be eligible for the $20 bonus, which could pay for your next three months to maintain this new business account.

9. LiveOak – $300 bonus

Expires: Limited Time

You can earn a $300 welcome bonus for opening a Live Oak Bank small business checking account and depositing at least $2,500 within the first 90 days or making 15 qualified transactions.

Bonuses are awarded within 45 days of completing these requirements.

10. Public – up to $10,000 bonus

Expires: Limited Time

If you have investments with another brokerage, you can easily transfer them over to Public without selling any shares.

Simply download the Public app and once your account is set up, go to your Settings. In the “Account” section, you’ll see an option to transfer your stocks to Public.

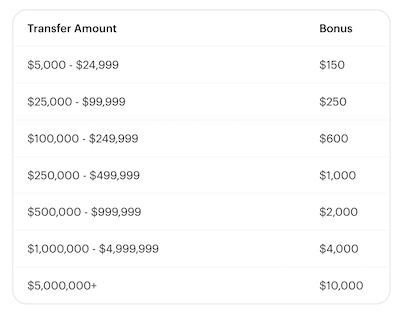

Public is making it easy and profitable for you to switch to their platform by offering a cash bonus of up to $10,000 when you open a new account, transfer assets via ACAT (wire for stocks), and keep the funds in your account for at least 6 months.

Note that the bonus is tiered and based on the total amount transferred. Cash transfers do not qualify and the funds must stay in the account for a certain period or the bonus will be clawed back.

Whether you’re leaving Robinhood, M1 Finance, WeBull, Charles Schwab, TD Ameritrade or any other US-based broker that offers ACAT-eligible transfer, Public can help.

11. M1 Finance – Up to $10,000 bonus

Expires: February 28, 2023

With M1 Finance, you can earn up to $10,000 to invest when you transfer your brokerage account to an M1 Invest Account by February 28, 2023. Score one of the best investment bonuses before it’s gone.

Jumpstart the new year with extra money to invest in your M1 account and make a transfer and earn the following:

- $50,000 – $249,999.99: $250

- $250,000 – $499,999.99: $1,000

- $500,000 – $999,999.99: $2,000

- $1,000,000 – $1,999,999.99: $4,000

- $2,000,000+: $10,000

Promotional Credits (see table above) will be paid to eligible clients on December 5, 2023.

Best Bank Bonus Now Without Direct Deposit Requirement

Here are more bank bonuses without direct deposit:

12. BMO Harris

If you own a business and you’ve got $10,000 you want to deposit into your new bank account, give BMO Harris a try. They’ll reward you with a $500 welcome bonus when you open a new Business Checking account. Plus, the bonus is tiered, so even if you don’t have $10,000, you can still earn some extra cash.

Besides depositing $10,000 into your account within the first 30 days, you’ll need to maintain that balance for 90 days and complete 10 qualifying transactions. If you maintain a balance of $5,000, you can earn up to $300. Once you’ve completed the requirements for your chosen tier, you’ll receive your bonus within 14 days.

13. Capital One

Open a 360 Performance Savings account with promo code FALL22 to jumpstart your savings. This tiered bonus system rewards you for how much you deposit into your new online savings account, as long as you keep that money in the account for 90 days. When you deposit at least $10,000 in the first 15 days, you’re eligible for $100 in rewards. To earn the full $1,000 bonus, you’ll need to deposit at least $100,000. After that, it only takes about 60 days for the bonus to be deposited into your account.

14. Citi

Citi’s bank account promotions are available in most states, but be sure to check the fine print to see if your state’s on the list. If it is, you’re eligible for up to $2,000 when you open a new Citi Priority Account. In fact, this bonus is tiered, so even if you can’t make the requirements for the $2,000 reward, you might still be able to earn extra cash for this bank account.

Depending on how much cash you have available on hand, you’ll need to deposit those funds by the 20th day after opening your new account. Those funds must remain there for 60 days after you’ve passed that 20th-day mark in order to earn Citi’s promotional bonus. Once you complete these requirements, however, your bonus should arrive within 30 calendar days.

If you deposit $10,000 into your new Citi Priority Account, you’ll earn $200. If you deposit $300,000 or more into this new account, you’ll be rewarded with $2,000.

15. Comerica

Comerica is offering new customers up to $500 in rewards for opening a Comerica Platinum Circle Checking account. You’ll need at least $50,000 to deposit into the account to earn $500, which will be credited to your account within 30 days. However, you must maintain that balance for at least 90 days to fully qualify.

In contrast to some of the other banks on our list, Comerica does count balances beyond your checking account to add up to that $50,000. If you have/open a linked money market, business checking, CD, or IRA account, you can use those funds as well to earn that Citi bonus.

16. Discover

Open a new Discover Online Savings account to earn up to $200 from Discover. This bank requires you to deposit at least $25,000 to earn that $200, but you can deposit and withdraw the money right away. Discover doesn’t require that you keep the money in the account to earn their bonus.

However, to fulfill the requirements for the $200, you will need to use the promo code GBP922 and make your $25,000 deposit within the first 30 days. Your bonus, once eligibility requirements are fulfilled, should arrive within 30 days.

17. Huntington

Huntington’s Unlimited Business Checking allows you to earn up to $400 for $5,000 total in deposits made within 60 days of opening your new account. You’ll have to keep your business checking account open for 90 days but your bonus should credit to your account within 2 weeks of meeting these requirements. In addition, if you only deposit $2,000 into your new account, you can still earn $100. And if you have $20,000 to deposit, you can earn up to $2,000 in bonus cash.

18. Partner Colorado Credit Union

Available to Colorado residents only, Partner Colorado Credit Union offers a $250 welcome bonus for opening a new personal checking account and setting up a personal Visa debit card. You can also take advantage of their auto loan bonus to earn up to $500 as well.

When you open a new Elevate or Elevate High-Interest Checking account and deposit at least $500 into it, activate your Visa debit card, and enroll in mobile/online banking, you’ve completed the necessary requirements for earning your $250 welcome bonus. This bonus shows up on your account within 10 days of meeting these requirements.

19. Redstone Federal Credit Union

This bank promotion is only available to Alabama and Tennessee residents who use the code YOUTH to open a new Redstone Federal Credit Union Youth Savings account for their child. This credit union will reward your child with $100 to match your deposit/average daily balance as long as you maintain it for the first 30 days. Your bonus will be deposited 60 days thereafter.

20. Rockland Trust Bank

A Rockland Trust Bank Personal Checking account can earn you up to $250 when you open your account at the Belmont Branch and make 15 debit card purchases totaling at least $10 each within the first 60 days of ownership. Once you complete these requirements, your bonus will be delivered to your account by the end of February 2023.

21. TD Bank

TD Bank offers a $500 welcome bonus to new customers in several states. As long as you deposit $20,000 into your new account within the first 20 days and maintain that balance for 90 days thereafter, you can earn the full $500. This reward is credited to your account within 140 days after you open your account.

22. Technology Credit Union

Tech Credit Union rewards new and existing customers with $3,000 when they deposit $1 million into their accounts. However, you don’t have to deposit the full amount into your online savings account. Instead, you can have it spread out across all your Technology Credit Union accounts.

If you have $20,000 to deposit instead of $1 million, you can earn $200 with this tiered offer. Regardless of which tier you qualify for, your bonus will be credited to your account no later than the end of March 2023.

23. Truist

Deposit at least $1,500 into your new Truist Business Checking account and use promo code SB22NEWBIZ4 to earn $200. You’ll have to enroll and sign into your new online banking account and keep that minimum balance of $1,500 for at least 30 days. Your bonus of $200 is deposited within four weeks of meeting these requirements.

24. Truliant Federal Credit Union

Open a Truly Free Checking account to earn $400. All you have to do is complete two qualifying direct deposits of $500 or more within 75 days and use your new debit card to make 10 qualifying purchases within the first 60 days. We know that our list highlights promotions that don’t require direct deposit, but you can use your pension or Social Security to make electronic deposits and qualify for this promotion.

If you’d like to take advantage of this offer, enter your email for specific instructions and to receive a redeemable certificate for $400 in gift cards. You’ll receive your reward within 60 days of completing the requirements.

25. Weokie Credit Union

Residents of major counties in Oklahoma can earn up to $200 for opening a Personal Checking account. This tiered bonus allows you to earn $100 just for opening the account with promo code GETPAID22. Residents who make 20 qualifying transactions within the first 45 days with their Weokie debit card can earn an additional $50, but if in those same 45 days you’re able to make a $250 deposit, you can earn $50 more.

Expired Offers

26. Ally Bank [EXPIRED]

Open and fund a self-directed investing account to earn up to $3,000 in rewards from Ally Bank. you’ll need to deposit at least $2 million or more to earn a $3,000 bonus, but this promotion is tiered to include other amounts as well. In fact, if you deposit only $10,000, you can earn $100 extra.

In addition to funding your account, Ally Bank requires that you deposit that amount within 60 days of the opening date. You must also maintain that balance for 300 days after opening your account. Ally will perform a review of your account 60 days after you open it and the bonus, if awarded, credits to your account within 10 business days.

Did you know that Ally also covers transfer fees up to $75 for amounts over $2,500? There’s plenty to love about opening an investment account with Ally, besides the opportunity to make some passive income.

FAQs

All of the banks above reward you for opening a new account without the need for direct deposit. While the amounts vary from one bank to another, it’s easy to get free money from a bank for opening a new account.

Truliant offers customers a $400 bonus, which is matched by Huntington when you deposit at least $5,000 into your account. You can earn up to $2,000 for depositing $300,000 or more into your Citi account, and Technology Credit Union will pay you $3,000 in bonuses if you deposit $1 million or more.

Yes, you can use the majority of the 24 banks above to open an account without a direct deposit. Be sure to read the fine print before you sign up to ensure you’re getting a bank account that fits your needs.

Bank on Your Future

We hope you’ve found this article helpful in terms of finding bank promotions you can take advantage of without having to set up direct deposit. In this day and age, banking continues to evolve and successful financial institutions work to change with those times. With the two dozen banks above, the limits of what banks can do for you expand to fit your lifestyle. What you do with those benefits, however, is up to you. Good luck choosing bank promotions without direct deposit requirements!