So you have student loan debt, right? But now you may be wondering if you can save money through student loan consolidation or student loan refinancing.

There are so many options out there and it can be hard to know what to choose. Should you consolidate your loans or refinance them?

The answer might depend on your individual circumstances, but here are a few things to keep in mind as you make your decision.

The biggest difference between consolidation and refinancing is that, with consolidation, you’re essentially combining multiple loans into one new loan. This can be beneficial if you have multiple loans with different interest rates and terms.

With student loan refinancing, you’re taking out a new loan to replace your existing student loans. This could help you get a lower interest rate, which could save you money over time.

With all the student loan refinancing companies out there, it can be hard to know which one to choose. Check out our list of the best student loan refinancing companies to see who might be a good fit for you.

Promo: Credible is the best place to compare refinancing options if you’re looking for a credit check-free experience that only takes 2 minutes.

If you just want the quick and easy comparison – go to Credible here >>

Benefits of Refinancing Your Student Loans with a New Lender

When you choose to refinance your student loans with a new lender, they may have a set of benefits for their customers.

Some refinancing companies have options to make bi-weekly payments to help with interest or to even have the flexibility to skip a payment during a difficult month.

It is good to research your potential companies before choosing who to refinance with and base your choices on the benefits they give.

The choice to refinance your student loans can be a great way to tackle college debt and lower your monthly payments. It can help you avoid going past due on your payments and prevent wage garnishment on student loans.

After all, everyone wants to save money, and refinancing could be the option for you to pay off your debt sooner and possibly build up your savings a little bit more.

While refinancing your loans may not be the best option for everybody, weighing your options will help decide if refinancing might be good for you and your bank account.

With lower interest rates, refinancing may help you save a lot of money on your overall student loan debt.

With that said, here are some companies we recommend if you wanted to look into refinancing.

| Product Name | College Ave Student Loan Refinancing |

| Min Loan Amount | $5,000 |

| Max Loan Amount | $150,000 or $300,000 (depending on degree) |

| Fixed Rate APR | 5.99% – 11.99% APR |

| Variable Rate APR | 5.99% – 11.99% APR |

| Loan Terms | 5 to 20 Years |

College Ave offers both private student loans and student loan refinancing. If you’re interested in refinancing your student loans, College Ave could be a good option since they have really low rates.

And, remember that low rates are very important if you want to save money through refinancing. In fact, a lower interest rate is one of the primary reasons why people refinance their student loans.

Why we like College Ave

College Ave offers student loan refinance options that can seriously reduce your monthly payments and even the total cost of your loan.

With low fixed or variable interest rates, no application or origination fees, and even lower interest rates when you sign up for auto-pay, they have student loan refinance options designed to reduce your stress level.

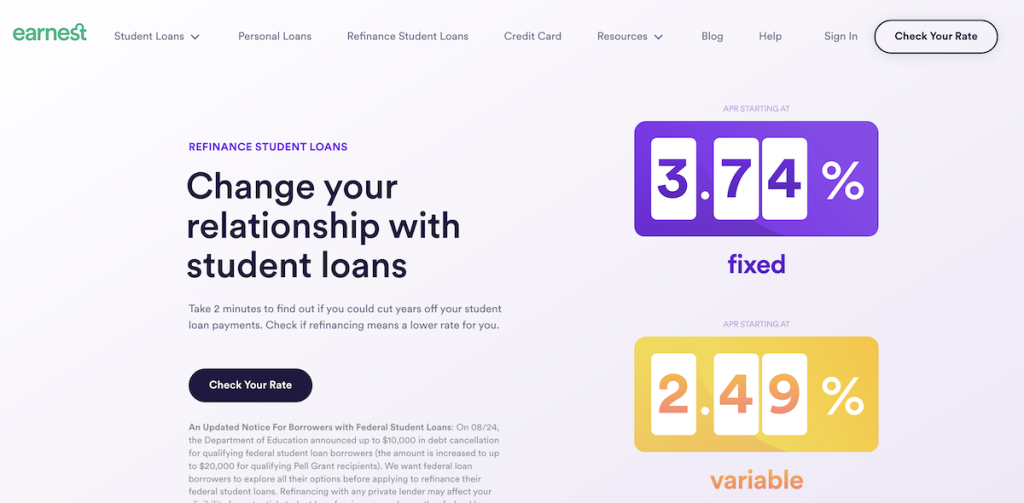

| Product Name | Earnest Student Loan Refinancing |

| Min Loan Amount | $5,000 |

| Max Loan Amount | $500,000 |

| Fixed Rate APR | 4.96% – 8.49% APR |

| Variable Rate APR | 4.99% – 7.99% APR |

| Loan Terms | 5, 7, 10, 15, 20 Year |

| Promotions | Refinance your student loan with Earnest and earn a $200 bonus when you sign your loan through this link. |

Earnest is a student loan refinancing company that offers rates as low as 4.59% APR for variable rate loans and 4.47% APR for fixed rate loans. Loan terms are available in 5, 7, 10, 15, and 20 year increments. There are no promotions currently being offered.

To qualify for a loan with Earnest, you’ll get some of the most flexible terms on the market. But to qualify you’ll need to to have enough savings to cover at least two months of normal expenses, including housing.

There are some other requirements but if you are interested in student loan refinancing with Earnest — you can check your rate in 2 minutes with no impact to your credit score.

If you decide to move forward with Earnest, they will pay off your current student loans and send you one monthly bill.

You can choose to have autopay set up so that you never miss a payment, or make manual payments online or with a check. There are no origination, application, or prepayment fees associated with an Earnest loan.

Why we like Earnest

Earnest is on this list because it offers more flexibility than other student loan refinancing companies. You can pick any monthly payment and term between 5 to 20 years, which could save you a lot of money in the long run.

They also allow you to modify your loan, with favorable rates and terms that can save you money. You may refinance your loan for free, change the payment dates, even skip a payment once a year and make it up later if necessary.

One of the great things about Earnest is that they don’t have set income requirements for borrowers. They also don’t charge any fees, and offer unemployment protection to pause your monthly payments if you lose your job.

Perhaps one of the best things about Earnest is that you can still refinance your loans, even if you didn’t finish your degree. As long as you meet their other lending criteria, they are willing to work with you.

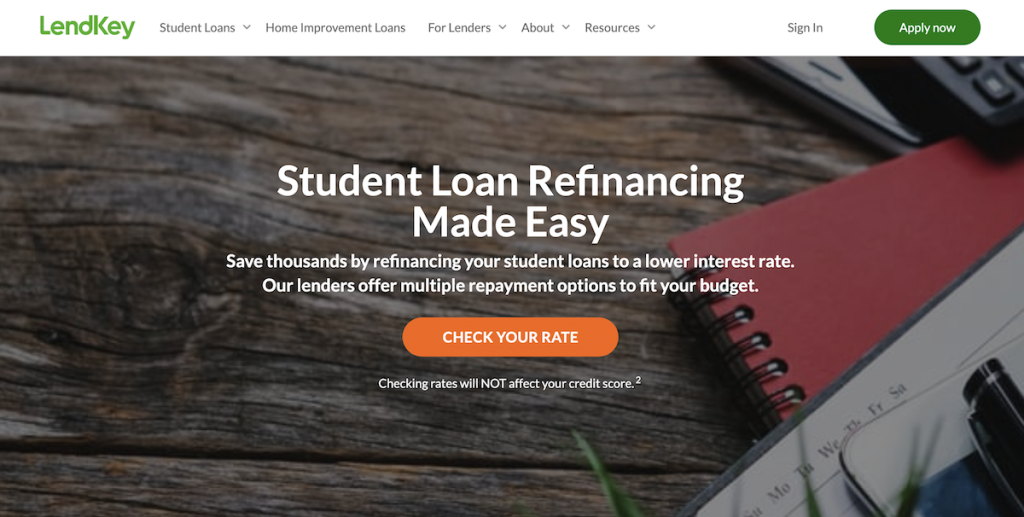

| Product Name | LendKey Student Loan Refinancing |

| Min Loan Amount | $5,000 |

| Max Loan Amount | $300,000 |

| Fixed Rate APR | 4.49% – 10.68% APR |

| Variable Rate APR | 4.89% – 7.39% APR |

| Loan Terms | 5, 7, 10, 15, 20 Year |

| Promotions | Up to $750 Bonus |

LendKey makes student loan refinancing easy and straightforward. You can check your rate in as little as two minutes, and there’s no impact to your credit score.

LendKey offers fixed and variable rates, with terms ranging from 5 to 20 years. You can choose the repayment plan that works best for you, and there are no origination or prepayment fees.

LendKey also offers a cosigner release option, so you can have your loans refinanced in your own name after you make 24 on-time payments.

Why we like LendKey

At LendKey, they work with community banks and credit unions to offer well-priced student loans to borrowers. By pooling money from multiple sources, they’re able to provide competitive rates that help our customers save on their loan payments.

They also offer a unique loyalty discount. If you have an existing loan with one of their partner lenders, you may be eligible for a 0.25% interest rate reduction on your refinanced loan.

LendKey is a great choice if you’re looking to save money on your student loans and want the option to release your cosigner after making on-time payments.

4) Splash Financial

| Product Name | Splash Financial Student Loan Refinancing |

| Min Loan Amount | $5,000 |

| Max Loan Amount | $500,000 |

| Fixed Rate APR | 5.34% – 8.37% APR |

| Variable Rate APR | 7.06% – 7.06% APR |

| Loan Terms | 5, 7, 10, 15, 20 Year |

| Promotions | None |

Splash Financial operates as a marketplace that facilitates student loan refinance loans from different credit unions and banks.

By completing a single application on the Splash Financial website, borrowers can receive offers from these lenders. This approach is similar to other online loan marketplaces like Credible and NerdWallet.

Why we like Splash Financial

Splash Financial stands out by offering a dedicated account representative and a prequalification process without a hard credit check.

With a dedicated account representative, borrowers receive personalized support throughout the loan journey. This representative serves as a reliable point of contact, providing guidance, answering questions, and offering tailored solutions.

The prequalification process is convenient and credit-friendly. Borrowers can check their eligibility and view potential interest rates without impacting their credit score. This allows for exploring loan options with confidence and informed decision-making.

These features enhance the borrower experience, ensuring personalized assistance and transparency. Borrowers can rely on the support of a dedicated representative and evaluate loan options without credit score concerns. Splash Financial aims to provide borrowers with a seamless and borrower-friendly loan process.

View Current Rates

If you’re ready to refinance your student loans, then you can save thousands or lower your monthly payment.

Student loan refinancing saves you money and you could snag a lower interest rate, decrease your monthly payment, or both. But which lenders are the best to refinance and save money?

The following table shows other leading lenders that specialize in refinancing student loans and helping you save money on them.

Keep in mind that checking your rate is free, and won’t affect your credit. The lenders above are the best in terms of rate and helping you lower your student loan payment for both private and federal student loans.

Should You Refinance Your Student Loans?

Making any decision that has to do with your finances is a big step and an important task. Finances are tricky, and it’s crucial to approach it in the right way and weigh your options. According to The Fed, student loan debt in the United States has recently reached $1.71 trillion, which means there are a fair amount of college graduates still in debt.

While no one likes to be in debt, lots of people are constantly looking for new ways to approach paying off their student loans in an efficient way. Refinancing your student loans is an option when trying to save money in the long run, so it’s definitely something to consider.

When you start to think about refinancing your student loans you may be on the fence about it because it may or may not be the best step for you. You’ll want to way the pros and cons of refinancing to decide what is the right decision for you and your finances.

Before making the decision you may want to think about a few things like, how much money you owe, what you can afford, and if there has been a change in your credit score or salary recently. Asking yourself these questions will help steer you in the right direction if you should refinance and who you should refinance with.

Overall, there are many benefits to refinancing your student loans that have a positive outcome on you and your financial state.

The Benefits of Refinancing Student Loans

If you have a secure job, emergency savings, strong credit, and are unlikely to benefit from forgiveness options, it may be a choice worth considering if you’re looking to lower your payments.

Let’s look at the other benefits of refinancing your student loans.

1. Lower Monthly Payments

Let’s be honest: who doesn’t want to save money on their monthly bills? One of the most popular reasons people choose to refinance their student loans is to lower the monthly payments. When you refinance, you may have a lower monthly payment which will help you save money each month that can be used in other areas such as paying bills, paying the interest faster, or putting into a savings account. Lower payments mean you may be able to afford to make an extra payment every once in a while, and you’ll save overall on the amount you owe.

2. Simplify/Consolidate Loans

Depending on who you choose to refinance with and what type of loan you have, many companies give the option to consolidate multiple loans when you choose to refinance. Consolidating your student loans means you are taking different loans that have different interest rates and are combining them into one new loan. The benefit of this is you are simplifying your debt and making it easier on you every month for payment purposes. You’ll have one low monthly payment each month for your student loans instead of multiple to keep track of.

3. Release Co-signer

When you first started college and applied for student loans, you may have had someone co-sign to help your chances of getting approved. Your parents or another relative might have co-signed your loans if you didn’t have enough credit built up to make the process of borrowing easier. At the time, it may have been the only chance to attend college but now that you are out of college, you’re likely in a different financial situation with more credit built up and a yearly salary.

Refinancing will allow you to release your co-signer so you are the sole individual listed on the loan. This benefit is extremely important because your co-signer is just as responsible for the loan as you are. So now that you are capable of paying your loan, it is time to release your co-signer from legal obligation.

4. Change the Loan Term

Refinancing your student loans will allow you to explore more options for how long your loan term is. There will be options to either shorten your loan or extend the loan. The repayment plans could come in 5 to 20-year sections depending on what you are looking for.

It is important to look at your financial standing now and potential financial standing in the future before choosing a new loan term repayment plan. The longer the term, the more interest you will pay but the shorter the term means there will be a higher monthly payment. You can take the time to weigh the pros and cons of each option the refinancing company is giving you to decide what is the best choice.

5. Lower Interest Rate

Josh Hastings, founder of the personal finance blog MoneyLifeWax, says when it boils down to it, paying off student loans is a really simple process once you understand how student loans work.

“Another option is to look into refinancing to reduce interest rates, but always make sure you know the pros and cons of federal versus private student loans,” Hasting says.

In fact, another popular reason that people choose to refinance their loans is to lower their interest rate. When you first applied for loans for college you may have had bad credit or even no credit at all, making your loans have a high-interest rate. Depending on where you are at right now, you could have had a salary increase, built up your credit, or even worked on your credit for a better score.

No matter what your situation is, refinancing will help lower the interest rate which helps you save money in the long run. There is no set interest rate that every individual receives, but you can research potential companies and they will give an overview of what their fixed interest rates range from.

Best Companies to Refinance Student Loans in 2023